Toyota Industries Corp (6201)

Capitalizing on the Toyota Group restructuring

Disclaimer: The information in this article reflects the personal views of the author and is provided for informational purposes only. It should not be construed as investment advice. The author does not hold a position in the security at the time of publication. Investment funds or other entities with which the author has consulting or advisory relationships may or may not hold a position in the security/securities discussed. The views expressed are solely those of the author and do not reflect those of any other parties. Readers should conduct their own research and consult a qualified financial advisor before making any investment decisions.

If you’re interested in a large-cap idea that has a mix of statistical cheapness, a clear catalyst, and an intriguing Japan corporate governance angle, then Toyota Industries Corp is worth a closer look.

A little-known fact: Toyota Industries Corp (6201), not Toyota Motor Corp (7203), was actually the “original” Toyota (from here, I will refer to the former as “TIC” and latter “TMC” to avoid confusion).

Founded in 1926 by Sakichi Toyoda to manufacture the Type G automatic loom, TIC expanded into automobiles in 1933. It built its first passenger car prototype (Model A1) in 1935 and spun off the automotive division as Toyota Motor Co. in 1937. It also spun off its steel division in 1940, now known as Aichi Steel.

In 1956, TIC entered the materials handling business, producing forklifts—a business that has since become its core. TIC is now the world’s largest forklift maker, with a 30% global market share (vs. KION at 14% and Jungheinrich at 9%). This business now accounts for 67% of TIC’s sales and 83% of its operating profit.

Where’s the opportunity?

At JPY 13,000 per share, the market cap of TIC is JPY 3.9 trillion (adjusted for treasury shares).

TIC owns 1.19 bn shares of TMC (9% of S/O), currently valued at JPY 3.3 tn. This accounts for 85% of TIC’s market cap.

TIC owns stakes in various Toyota group companies, collectively worth JPY 0.9tn, or 23% of TIC’s market cap. The largest are:

Denso: 157 mn shares (5.4% of S/O), JPY 306 bn market value

Toyota Tsusho: 118 mn shares (11.2% of S/O), JPY 304 bn market value

Toyota Fudosan: Unlisted, fair value of JPY 132 bn according to TIC’s March 2024 Yuho.

Ibiden: 6.2mn shares (4.5% of S/O), JPY 26 bn market value.

Aisin Corp: 7.7 mn shares (3% of S/O), JPY 14 bn market value

Other listed and unlisted stakes: Fair value of roughly JPY 90 bn as of March 2024 according to Yuho.

TIC has JPY 1.3 tn of net debt (total debt minus cash).

Major shareholders of TIC include: TMC (24% of S/O), Denso (6.8%), Toyota Fudosan (5.3%), Toyota Tsusho (5%), Aisin (2%). Thus, Toyota group firms own at least 43% of TIC shares.

Confused yet? I hope not! This is typical of Toyota group shareholding structure.

Adding these up, TIC has an EV of JPY 1 trillion and is forecasted to generate JPY 220 bn in OP for FY2025/3. That’s an EV/EBIT of just 4.5x for the world’s leading forklift manufacturer. Given its growth profile, I think a more reasonable valuation would be 10-15x EBIT, implying a potential 2-3x return potential.

The undervaluation is clear. But what’s the catalyst for unlocking this value? Toyota Group restructuring.

Toyota Group restructuring

The restructuring is still in the early stages, although I think the trend is quite clear.

Industry change

TMC Chairman Akio Toyoda has repeatedly stressed that the automotive industry is undergoing a “once-in-a-century shift” driven by technology changes (vehicle electrification and autonomous driving) and the rapid rise of competition (Chinese OEMs in particular).

The Toyota Group structure was a competitive advantage in the past, but it’s starting to be regarded as a liability, even by Toyota management.

Increasingly, TMC will have to design cars from a “first principles” approach. This includes breaking down the barrier and working with global suppliers, not just within the Toyota Group.

Case in point: Toyota’s new EV for the Chinese market, the bZ3X, is its lowest-priced EV ever at only RMB 110,000 (USD 15,150). TMC chose Nidec’s low-cost electric motor and made extensive use of local Chinese suppliers to bring down cost. Even the ADAS was jointly developed with Momenta, a Chinese company.

The more TMC faces competitive pressure from Chinese OEMs (both in China and globally), the faster the Toyota Group restructuring is likely to be.

By the way, if you’re bullish Chinese automakers and believe in them taking over the world, then betting on Toyota Group restructuring might be an indirect way to play this.

Capital markets pressure

TMC is also facing mounting capital markets pressure.

It was recently reported by Nikkei that TMC is considering adopting a 20% ROE target. TMC’s ROE in recent years ranged from 9-16%, while BYD’s ROE surpassed 20% in FY23 and FY24.

This 20% figure hasn’t yet been officially confirmed by TMC, but corporate actions coming out in the last 1-2 years clearly indicate TMC’s shift to prioritize capital efficiency. This includes the partial sales of stakes in Denso and Aisin, and raising the share repurchase limits on a previously announced large-scale repurchase in 2024.

Another surprise was the decline in Akio Toyoda’s approval rating, which fell from 96% at the 2022 AGM to 85% in 2023 and then to 72% in 2024. Proxy advisors ISS and Glass Lewis recommended shareholders vote against the re-election of Toyoda (as well as Vice Chairman Shigeru Hayakawa), expressing concerns ranging from certification testing violation to corporate governance.

In February 2025, TMC announced plans to transition to a “Company with an Audit and Supervisory Committee” to strengthen board oversight and independent director roles. It’s clear this is an appeasement effort after facing mounting capital markets pressure in 2024.

Now let’s shift our focus back to TIC:

TIC has sold down its stake in Aisin from 7.68% to 3% between March to September 2024.

In October, it announced it will sell off all of its Denso shares and will also “review other held shares in the future”.

In May 2024, it announced a major share repurchase (up to 180bn yen, equal to 4% of S/O). Very positive, as it clearly signals that management is willing to return, rather than hoarding, cash from share sales.

It’s interesting to see that TIC seems to be taking a more drastic approach to restructuring than TMC. It makes sense, as TIC is essentially a standalone forklifts maker and has little rationale to be tied down to the Toyota Group.

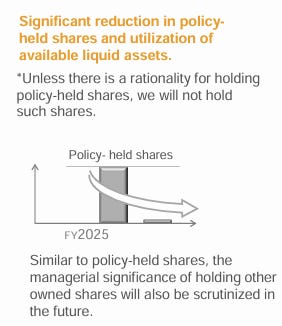

The diagram below, taken from TIC’s corporate presentation, shows “policy-held shares” going to almost zero. We should expect the sales of Toyota Tsusho, Toyota Fudosan, and other held shares in the future. As for TMC, this may be part of what management refers to as “other owned shares” which they have not yet committed to selling down but will be “scrutinized in the future”.

As the Toyota Group restructuring proceeds, the end game for TIC shareholders is that it’s left owning the world’s largest forklift maker at a bargain price, with excess cash that will either be returned to shareholders or reinvested into the warehouse automation area (where there is actually good business rationale for doing so).

Business outlook

Material handling equipment segment (Industrial Vehicle in the chart above):

TIC has benefited from the logistics and warehousing boom. Revenue is up 76% compared to pre-COVID levels, growing at a 12% CAGR over the past five years. The weak yen has helped, but growth remains strong.

Going forward, management sees warehouse digitization and automation as a key growth driver. Currently, solutions sales contribute 20% of the segment’s revenue, and there should be room for further expansion, possibly through M&A.

Automobile segment:

This segment mainly supplies TMC and engage in the production of vehicles (RAV 4), engine (Landcruiser, Hiace, RAV 4), air conditioning compressors, and vehicle electronic parts. Margins are abysmal (under 2% OPM last year, and even in good years 3-4%). It essentially acts as TMC’s off-balance sheet production asset, and it obviously has no bargaining power over TMC.

I’m not sure what happens to this segment over time. The most logical course would perhaps be to sell the assets to TMC, but I doubt TMC would want to buy it. Maybe TIC will be left carrying this bag for a while. Or maybe the assets could be sold to new entrants into the auto industry, like Foxconn.

Risks

While we wait for the Toyota Group restructuring to progress, a risk is TMC losing its competitiveness faster than expected, leading to its shares losing value.

Another possible outcome is that TMC launches a takeover bid for TIC, “stealing” it from minority shareholders. While this risk has been often discussed in the past, I think it looks less likely now. TMC’s focus on capital efficiency means it likely wants to be leaner, rather than consolidating legacy auto production assets and TIC’s forklift business which is unrelated to TMC’s core.

Plus, TSE’s new ruleset for the protection of minority shareholders (in the case of MBO, etc.) is expected to be released in Spring 2025, which should further mitigate the risk of take-unders.