Sysmex is one of the most well-managed and globally successful companies in Asia's healthcare sector.

The company’s bread-and-butter is testing equipment used in hematology - the branch of medicine concerned with the study of blood components and related disorders. Sysmex’s equipment and reagents are used in a wide range of settings from routine blood tests offered at clinics, to cutting-edge fields including novel blood-based tests for Alzheimer’s and liquid biopsies for cancer detection, to name a few.

The company’s closest listed comparable is Danaher - a high-quality business that many global investors are undoubtedly familiar with. Sysmex is smaller, and is more of a pure-play compared to the conglomerate Danaher. But where these two players overlap - in hematology - Sysmex has been outexecuting its bigger competitor for decades, and has decisively won the global market!

Sysmex’s core hematology franchise holds the leading market share globally, providing investors with highly defensible cash flows and a growing topline at a high single-digit rate. In Part 1 of this report, we explore Sysmex’s high-quality core business, and its fascinating corporate history that led to it conquering the global market for hematology despite being a latecomer to the market.

In addition to this, there are two notable growth options today that investors may not yet fully appreciate. I believe Sysmex possesses the right-to-win in these areas and is at the cusp of a growth inflection point.

Sysmex has recently commercialized a novel blood-based test for Alzheimer's, positioning itself to become a key player in this crucial area. It can be viewed as a picks-and-shovels in the rapidly developing Alzheimer’s field, where therapeutics have recently started to take off, and testing technology must soon follow.

In 2020, Sysmex launched Japan’s first surgical robot, the Hinotori. While the penetration of robotic surgery in Japan remains modest, growth is set to accelerate. Sysmex has the potential to capture significant value by focusing on the Japanese market alone, where I believe the company is better positioned for growth relative to global leader Intuitive Surgical.

Part 2 of this report will delve into these valuable growth options, management, and valuation.

A special thanks to Jeff Musial of VARECS Partners in Tokyo who helped provide some of the initial insights for this report.

Disclaimer: Creating reliable hematology equipment requires precision, dedication, and decades of cumulative knowhow – not something you can just fake with a turtleneck and a deep voice.

Background

So how did Sysmex become so dominant? Well, it wasn’t always this way. Established in 1968, Sysmex was a latecomer that lived in the shadow of the original hematology pioneer, Beckman Coulter.

In 1948, American scientist Wallace Coulter invented the Coulter Principle which provided a method for counting and sizing microscopic particles suspended in fluid. This was a generalized principle, but it became significant in healthcare due to its application in hematology.

In 1953, a patent was awarded and Coulter Electronics was incorporated, creating the first hematology analyzer (known as the Coulter Counter at the time).

When people refer to getting a ‘blood test’, they are often referring to a Complete Blood Count (CBC) test, which is one of the most commonly conducted tests in a general healthcare setting. The test provides vital information about the health of a patient through analyzing different components of blood. Thanks to the Coulter Principle, this became entirely automated. Up until then, doctors had used microscopes to examine blood samples and performed manual counting of blood cells. Automation led to faster and more accurate counts.

Coulter Corporation was acquired in 1997 by Beckman Instruments, becoming Beckman Coulter. Then in 2011, Beckman Coulter was acquired by Danaher.

In the early days, Coulter enjoyed a global monopoly, and Sysmex was just a baby. Working around Coulter’s patents, Sysmex developed its own (Japan’s first) hematology analyzer in 1963. Eventually, Sysmex went onto win the Japanese market from Coulter. Then in the 1990’s Sysmex began expansion on two fronts. First, it expanded into other areas of testing, like urinalysis and immunochemistry. Second, and more importantly, Sysmex began the international expansion of its hematology business.

The overseas expansion turned out to be massively successful, and today, 85% of Sysmex’s sales are generated outside of Japan (the majority of this is hematology).

Like most Japanese products, Sysmex’s machines were high quality and reliable. But beyond product quality, for decades Sysmex made canny decisions in business development that in our view separate it from the pack of most Japanese companies. In 1998, Sysmex struck a global partnership with Roche, who became the distributor for its machines because it needed a top-quality hematology analyzer in its product lineup. Sysmex leveraged this Roche relationship to gain initial traction in overseas markets. But over time as it gained scale and accumulated knowhow, Sysmex took back control of these overseas operations themselves.

A key reason it was able to do this was that from the beginning, it had agreed with Roche that its analyzers would bear its Sysmex brand name on them, instead of white labeling them as Roche devices - meaning that Roche’s international sales network helped build Sysmex’s brand worldwide! This has worked out well for Sysmex, and it continues to be the the company’s MO - most recently in Brazil where the company has been buying out distributors and converting to a direct sales and servicing model.

Outcompeting Beckman Coulter

So how did this latecomer Japanese company come to dominate the field of hematology, overtaking Beckman Coulter (now Danaher) - the original inventor and pioneer?

To state the conclusion, I believe Sysmex was a winner due to two factors - its tremendously executed international expansion and sharp focus on iterative R&D in hematology, as well as the multi-year stumbling of Beckman Coulter.

Each time Coulter became part of bigger organization, organizational reshuffle led to focus being shifted away from core hematology in favor of areas like immunochemistry that were larger, faster growing, and had greater pricing power for test reagents. The acquirers all wanted to prioritize the faster growing, bigger market, which left hematology as a neglected area starved of resources and R&D. This was in contrast to Sysmex which had set its sights squarely on dominating hematology.

The shift in focus at Beckton also led to cultural rifts, dividing employees into the hematology vs. immunochemistry camp. This resulted in employee departures, many of whom went on to join Sysmex. One former employee described it as a “not-super-happy marriage in terms of who was steering the Beckman Coulter boat”.

“Coulter is the big hematology company for decades. They've been overtaken by Sysmex. I think Sysmex has 85% or more of the market right now. Coulter's still using almost the same technology that they used when they discovered it. They haven't evolved and they've been taken over by Sysmex...”

- Customer perspective, Ready – National Laboratory Director (April 2022, AlphaSense Expert Insights)

“I think the challenges with the company run much deeper than anything that simple management changes can fix. I think the R&D pipeline as a whole needs to be revamped and rethought. A lot of these changes that would position Beckman better for the future would take a lot of investment, a lot of time.”

- Former Sales Executive at Beckman Coulter (April 2022, AlphaSense Expert Insights)

Now, framing Sysmex’s success as simply a function of Coulter’s failure is giving too little credit to Sysmex’s management. They have become the industry gold standard. As this Laboratory Director who has plenty of experience using all the competing maker’s equipment discusses:

“Sysmex never breaks. Sysmex is more accurate, uses less reagents. I only met one person in the last eight years that didn't like Sysmex. It's almost a consensus throughout the laboratory. Even in a small hospital, "Give me one Sysmex instrument. That's fine. I'll be good. If you want me to go to Coulter, you still need to give me two. Why do I need two? It usually breaks."

- Customer perspective, Ready – National Laboratory Director (April 2022, AlphaSense Expert Insights)

Beckman tends to be preferred by older technicians, while newer technicians tends to prefer Sysmex. As smaller and older hospitals (where these older technicians usually resides) get acquired within a hospital network, a new procurement system is brought in, which typically favors Sysmex - another reason why Sysmex has been gaining share.

Finally, there is a slight difference in the philosophy between the two companies. The “Danaher Way”, similar to the famous Toyota Way, emphasizes just-in-time inventory system and continuous optimization in operating metrics. For example, this is reflected in the number of inventory days, with Danaher being consistently lower by 30-40% compared to Sysmex (127 days vs 86). However, Danaher’s lean strategy backfired during Covid when Coulter had challenges fulfilling customer orders and ceded market share to Sysmex.

This is not to say that Sysmex is a better company than Danaher. You have two companies with different philosophy, focus, and business mix. But nevertheless, their different approaches to the hematology market led to Sysmex emerging as the clear winner.

In general, many Japanese healthcare companies are pure-plays. Being a big fish in a small pond is a recurring strategic focus - Sysmex, Terumo, and Olympus are notable examples. Management is first and foremost concerned about protecting market share and profitability in their niche, while investing in larger therapeutic and diagnostics areas albeit doing so selectively. On the other hand, Western makers have the tendency to evolve more into healthcare conglomerates, using M&A to gain technology, scale efficiencies, and bargaining power over buyers.

Diagnostics remains an area where Japanese companies tends to be quite strong. On the other hand, Japan relies to a great extent on Western makers for therapeutics. Expansion into therapeutics, or even advanced diagnostics areas like immunochemistry, requires a lot of resources. This is why management is crucial - with an R&D budget limited in size compared to their Western peers, Japanese firms have to be especially selective and smart in where R&D resources are deployed.

I believe Sysmex’s management has done just that. They have focused on strategic areas that plays to their strengths - a decision which I believe positions Sysmex well to lead in these markets. We’ll dive deeper into these in Part 2.

While I am a fan of Japanese companies’ “big fish in a small pond” strategy, the drawback is that the smaller scale and the limited breadth of product portfolio can be a challenge, especially when going up against much larger Western counterparts. With their diverse product lines, these players are comprehensive suppliers. In addition, they have accumulated supplier power, positioning them better in response to trends like the consolidation of customer purchasing, as seen through GPOs (Group Purchasing Organizations) in the US and elsewhere in the world.

“What you're seeing in this market is individual hospitals consolidating into larger health systems. Instead of having your major customers being individual buyers, they're usually now a 27-system hospital network in which they have much higher bargaining power. The sale is much more complicated. You're not just selling one solution into one hospital. You're selling one solution to 27 different hospitals.”

- Former Sales Executive at Beckman Coulter (April 2022)

Japanese players have largely remained on the sidelines during the big wave of medical devices M&As over the past decade. Now, perhaps this is a good thing for the Japanese, as large-scale foreign acquisitions don’t usually turn out well!

Business segments

The medical diagnostics market consists of two markets:

In-vitro diagnostics, which involves taking samples and analyzing them (e.g. blood, urine, biopsy)

In-vivo diagnostics, which involves testing living subjects (e.g. X-ray and MRI scans)

The market we are primarily interested in this report is the in-vitro (IVD) market. Most market intelligence sources estimates the market size at roughly $100bn per year.

Sysmex offers a full range of equipment, from compact point-of-care testing devices to scalable and high throughput systems used at commercial labs. The attractiveness of this business comes from its very high recurring revenue: consumables (reagents) sales accounts for 60% of topline plus another 13% in servicing. Once a piece of equipment is sold, 5-8 years of recurring revenue is guaranteed. This is similar to peers like Danaher and Thermo Fisher - all exceptional businesses.

Looking at Sysmex’s diagnostic areas, one useful way to think about them is to group them into core versus strategic areas.

Core:

These are highly established diagnostics areas with large test volumes. Sysmex has the top global market share in three areas: hematology, hemostasis, and urinalysis.

Sysmex’s bread and butter is Hematology (59% of total revenue). CBC (Complete blood count) test measures red and white blood cells, hemoglobin, platelets, among other components of blood. It’s a common blood test used to evaluate the overall health of a patient, and can help detect a wide range of disorders and diseases. Sysmex has 50-60% global market share here (up from 40% range a decade ago).

Another testing area related to blood is Hemostasis (16%), although the machines and reagents used here are different from hematology. Hemostasis tests for the degree of blood clotting. In the human body, some amount of blood clotting is healthy. But we don’t want too much clotting (myocardial infarction or stroke) or too little (hemophilia or excessive bleeding). Sysmex operates the hemostasis business together with Siemens, where Sysmex supplies the equipment and Siemens supplies the reagents in a global distribution partnership.

While Sysmex focuses on blood-related analysis for the most part, there is an exception with Urinalysis (8%) which uses urine sample to detect conditions like urinary tract infections, kidney disease, and other metabolic conditions. This is a highly prevalent but a somewhat commoditized test area. In this area Sysmex is partnered with Eiken Chemical (4549), a small-cap Japanese maker of diagnostics products that specializes in fecal and urine testing (an interesting company on its own that you may want to check out).

Strategic areas

The three fields above (hematology, hemostasis, urinalysis) together accounts for only about 10% of the global IVD market. We can see that Sysmex is a big fish in a small pond.

So what does the rest consist of? Immunochemistry (6% of Sysmex’s revenue), which relates to the immune system and deals with areas like infectious diseases and cancer, comprises one third of the total IVD market. As it deals with major disease areas, this field can be hugely profitable for firms that successfully develop effective and scalable solutions.

Immunochemistry is recognized as a highly innovative sector. It's often very difficult to develop reagents for immunochemistry (think of it as almost like developing a new drug). The critical nature of these tests and the higher technological hurdles means these tests can also be priced extremely expensive. It represents a higher risk but also a higher reward business for companies.

It takes a lot of R&D to play in this field. In addition, because hospitals and labs typically look for equipment that can perform a wide range of tests (e.g. various tumor markers, proteins, antigens/antibodies), the business has a high barrier to entry and tends to favor large, well-resourced players with wide product portfolios.

The Life Science segment (5%) also operates at the cutting edge. Sysmex entered this field via acquisitions. The first was Baltimore-based Inostics in 2013, which is focused on the growing field of liquid biopsy (blood) for cancer detection. In 2017, Sysmex acquired the genomics player OGT (Oxford Gene Technology). Its brand, CytoCell, produces something called “DNA probes”. These are are sold to labs to detect the presence of certain DNA sequences, equating to genetic abnormalities or mutations, which can be precursors to different types of disease.

Let’s look at how Sysmex has done in each of these areas - see below table.

Core: The strong growth in hematology should be no surprise given Sysmex has won the market in ways which we just described. Hemostasis has also performed well. To have two core segments (accounting for 70% of revenue) growing at high single digits provides a solid foundation, before we talk about the strategic areas.

Strategic areas: The fastest growing segment is Life Science, followed by Immunochemistry, but these are off of a relatively smaller base. There is also a medical robots venture that recently obtained regulatory approval and is fast ramping, although this is a totally different product area which we’ll later cover.

Market growth: Due to aging society and higher incidence of diseases such as cancer, test volumes have been growing globally. Industry experts seem to agree that the IVD market should grow at mid-single digit CAGR over the next five years. Sysmex has also been making inroads in developing countries where testing volume still remains at a fraction. For example, India is a current priority where the company has recently established a new factory for local production and expects sales to exceed 6 bn yen in 2024, and 10 bn by 2026.

New product cycle: There isn’t a lot of new product launches in this business, but Sysmex has recently undergone a product refresh. The XR-series hematology analyzer was launched in July 2022 in Japan, eleven years after its predecessor XN series. Improvements includes 10% increased throughput and tools to optimize lab technician workflows (i.e. more automation). The company is currently in the process of a global roll-out of the XR-series and well positioned in the product cycle.

Dedicating more sales resources: Sysmex operates its Hemostasis business via its 25+ years partnership with Siemens Healthineers. Sysmex supplies the hardware in this relationship while Siemens provides the reagents. Recently, this partnership has been restructured with the goal of accelerating sales growth. Previously, each player focused on their respective geographies, but going forward both players will be able to distribute each other’s products globally, even in regions where there is overlap in sales resources. This ensures more resources are dedicated overall to growth.

It’s worth noting that management expects the sales growth of Hemostasis to meaningfully increase (guiding for 13% CAGR during FY23-26, as compared to 8% realized from FY17-23), underscoring their confidence in the new initiative.

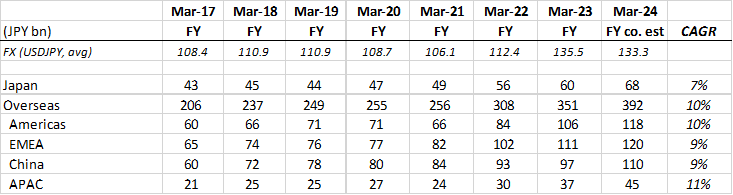

As shown below, Sysmex’s topline growth has been consistently high across geography. In Japan, Sysmex operates a diverse product portfolio where hematology only accounts for one third of total sales. Overseas, hematology accounts for two thirds, and this is the highest in Americas (82% of sales).

Sysmex has consistently grown its recurring sales ratio (=reagents plus service) which has reached 73% of total sales:

Now that we are familiar with the fundamentals, we can start to look at some of Sysmex’s exciting growth options. To be continued in Part 2...

If you enjoyed this piece, subscribe and share with your friends or colleagues!

Sounds like it's a strong company with exciting growth prospects! Before I read part 2, I'm curious about what you think about Sysmex's partnership with Siemens in the Hemostasis business - do you think the two firms would run into conflicts of interest when distributing in each others' geographical regions?

Great article! Interested to learn more about their robotics business, I like ISRG a lot.