Recruit Holdings (6098, RCRUY)

Japan's best managed tech conglomerate

Note: This article was originally written on April 17, 2023

Introduction

Recruit Holdings is an internet, media, and services conglomerate headquartered in Tokyo. We consider Recruit to be a true blue-chip and one of the best managed companies in Japan. The company is listed on the Tokyo Stock Exchange (6098), and also has US-listed ADR with the ticker RCRUY (5 shares of ADR = 1 ordinary share).

Recruit is a household name for Japan-focused investors. But why should other investors care about Recruit?

Recruit is headquartered in Tokyo, but over 70% of group profit is generated outside of Japan. Most of this comes from US-based global job aggregator and portal Indeed which was acquired in 2012. Recruit should be benchmarked against US and global peers.

Marketplace businesses tends to attract investors - and for a good reason as these can turn out to be highly lucrative. In terms of scale, the jobs market is the biggest marketplace opportunity of them all. But there aren’t many high quality, scaled marketplaces in this space that are publicly listed. Through Recruit, investors can own a global champion.

Out of Recruit’s other businesses, the fast-growing “seller solutions” suite of SaaS tools for retail stores in Japan that’s benefitting from Japan’s Covid recovery is particularly attractive. It’s also worth pointing out that Recruit is a very well-managed organization. This is not a situation where investors are buying a badly managed holding company just to obtain exposure to its crown jewel (a pattern that we see quite often).

As of late, Recruit’s shares have pulled back given concerns of a cooling jobs market in the US. Cyclical risks notwithstanding, what we emphasize in this report is that Indeed is a structural grower, with significant opportunity to address a large and growing market as the global leader in HR technologies. Not only does Recruit have a long runway, it is also profitable and financially well-managed.

Recruit trades at a forward P/E of 21x and EV/adj.EBITDA of 10x. Share price is 20% lower than where the company last announced share repurchases (October 2022). Recruit has $6bn in net cash (roughly 14% of market cap), and given its strong balance sheet further repurchases are possible and could serve as near-term catalyst.

Business segments

Recruit has a long history dating back to 1960, and operates a diverse portfolio of businesses. Over the past few years, Recruit has shifted its focus to becoming an “HR Technology company” - this came as a result of the blowout success of Indeed.

Recruit operates three business segments:

HR Technology – Recruit paid $1 billion to acquire Indeed in 2012, and last fiscal year Indeed generated close to ~$3bn in adjusted EBITDA (62% of company’s total). This has to be one of the most successful overseas acquisition ever done by a Japanese company! Practically all of the profit in HR Technology segment came from Indeed, but the segment also includes US-based Glassdoor which was acquired in 2018.

Matching & Solutions – Recruit owns a large number of Japan’s leading consumer media portals and apps, including real estate, beauty, bridal, travel, dining, and classifieds. Recruit has decades of experience operating these media. In the past they used to be mainly print magazines, but Recruit has successfully transitioned them into the digital age. This segment also includes a SaaS business which offers a suite of business tools for retail stores including point-of-sale, HR/worker management, payments, and more (these are comparable to US-based Square’s seller solutions business).

Staffing – Recruit operates traditional staffing business in Japan and overseas

A deep dive on Indeed

Indeed was founded in 2004 by Rony Kahan and Paul Forster. Today it’s the largest job aggregator in the world with 300 million unique visitors per month.

It’s called a job aggregator because in the early days it mainly scraped the internet for job listings from career pages, job portals, and other websites. Job listings were highly fragmented, and Indeed had this great technology to aggregate and present them in a user-friendly way. As an aggregator, Indeed was able to amass the largest collection of job listings on the web. This was very powerful, allowing it to disrupt the traditional job portals (who remembers Monster.com?) with the aggregator model.

As Indeed became hugely popular with job seekers, employers also took notice and started to create employer accounts which allowed them to “sponsor” listings, and also to list jobs directly on Indeed. After all, employers just want to be where the applicants are. This virtuous cycle is shown below. Today, Indeed has a mixture of aggregated (third party) and direct listings, but increasingly the mix has shifted towards the latter. No longer is Indeed just a pure aggregator.

Indeed is completely free for users and monetizes by charging employers. Employers can post job listings on Indeed for free but they need to pay if they want to “sponsor” their listings. The model here is very similar to Google AdWords. The only thing an employer needs to do is input their ad budget and duration of campaign, and then leave it to Indeed’s algorithm to optimize the rest.

“Their algorithm is actually really interesting, in that if you have, let's say $100 to put on a job for a week, it's not going to split that $100 evenly. It's going to put more of that money on Monday, and Tuesday, and Wednesday because they are the highest traffic days, and that's when it's most likely for people to be searching for jobs. Actually, push it then, and then you'll spend very little on days like Friday when nobody's looking for a job, or Saturday. They're very smart about their product, how it works, how to get people engaged and interested.”

– Former Indeed Senior Enterprise salesperson (Dec 2022, Stream Transcript)

Here’s roughly how it works: a $100 budget is enough to buy 100 clicks if the cost-per-click is $1. After 100 clicks is reached, the ad is taken down from sponsored listings and becomes just a regular listing. How much the $100 can buy depends on the competition for sponsored listings - so if there are many competing employers that are all trying to sponsor similar listings, then the cost-per-click might go up to, say, $2 so that $100 will only get you 50 clicks. To get 100 clicks as before, employers will need to up their budget to $200 in this case. This is how competition (a tight labor market) leads to higher earnings for Indeed.

Sponsored listings is the bread and butter for Indeed’s monetization. According to a former employee, it accounts for roughly 80% of its profit. Indeed’s other products include:

Featured Employer, which is a branding product that allows employers to make their listings more visually attractive and create employer profile pages with rich media content.

Indeed Resume is a subscription-based product which offers employers the ability to browse through over 200 million resumes and contact candidates using direct mail.

New innovative products like Indeed Hire, Indeed Hiring Platform, and Indeed Flex which we will get into later on.

As we mentioned earlier, a tight labor market benefits Indeed as employers spends more on the platform. This is precisely what the industry saw during the Covid recovery phase as employers needed to fill their positions fast and competed fiercely for hires. It also results in an environment where Indeed can more easily cross-sell its newer products in addition to sponsored listings. The fact that job shortage was especially acute for blue collar jobs, which is Indeed’s strongest area, further drove business growth during Covid recovery. All of this led to Indeed’s phenomenal growth last fiscal year as shown below.

Granted, the extremely tight conditions in 2022 was a one-off. Quarterly trends above show that Indeed reached a cyclical peak in revenue in the September 2022 quarter. Then in March, Indeed laid off 2,200 employees or 15% of its workforce.

“Last quarter, US total job openings were down 3.5% year-over-year, while sponsored job volume fell 33%. In the US, we are expecting job openings will likely decrease to pre-pandemic levels of about 7.5 million, or even lower over the next two to three years”.

- Chris Hyams, CEO

This also echoes the warnings given out by ZipRecruiter, Indeed’s competitor in the US, earlier this year.

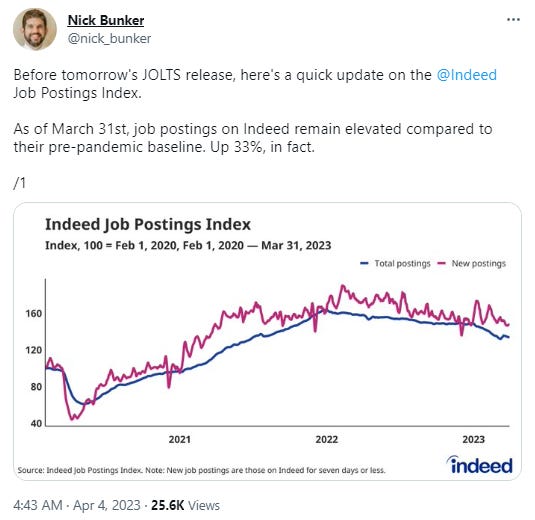

If you are interested in the economics and data, we suggest following Nick Bunker, an Economist at Indeed.

While the cyclical trends are not great, labor market tightness has so far proved to be stickier than many had predicted. And shortages in certain areas of the economy are more structural, for example essential workers like nurses which is not sensitive to business cycles (below). Post-Covid, a new type of work-life balance became the norm, and it’s also debatable whether these human habits can be so easily reversed in just a few quarters. In our view, it’s unlikely that everything is simply going to mean-revert back to pre-pandemic conditions; rather there is probably a new normal that will be here to stay for a while.

Growth is far from over

Now let’s talk about the structural opportunities for Indeed and why we are excited about Indeed’s future if we zoom out and think about where the business could in the long term.

“As long as Indeed keeps investing heavily in new products and perfecting products, which is what they do constantly, I think they’re going to continue to grow for years to come…I don’t think Indeed is in any trouble plateauing just yet”

– former Director of Sales at Indeed (Sep 2022, Stream Transcript)

To add context to the above quote, hiring is filled with frictions and inefficiencies. According to one study done by Indeed, it takes on average 15 weeks for job seekers to get a job. And during that period, 50% of job seekers experience job search duration longer than their personal financial runway. In other words, the problem to be solved is big, and far from being saturated.

If we look at Recruit’s product strategies, they have an overarching goal which is to add value to employers and their HR departments. This falls under two categories:

Provide higher quality matches (= Indeed becoming more “intelligent” at what it does)

Going down the hiring funnel (= Indeed taking on more tasks that would otherwise be done by the HR department, helping them automate their manual tasks)

Let’s take a closer look.