Kyoritsu Maintenance (9616) Part 1

My top pick Japan tourism play at 14x 2025 EPS

There’s an old rule in investing: avoid cutthroat, commoditized industries. Fair enough. Industries like retail and airlines are classic examples.

But every so often, a company breaks the mold, building a differentiated brand with a loyal fanbase in an otherwise commoditized business, creating a ton of shareholder value along the way.

In retail, a good example is Japan’s Pan Pacific Holdings, which operates the famous Don Quijote stores. They’ve turned shopping into a treasure hunt, with endless surprises for customers around every corner. Don Quijote’s “organized chaos” retail concept has become enormously popular with both Japanese locals and tourists alike.

In the US, Southwest Airlines redefined the airline industry, as a budget airline known for having a “personality” and being customer-oriented. Customers love Southwest for perks like free checked bags, flexible cancellation policy, and a fun crew that occasionally turns a pre-flight safety briefing into a rap.

Today I am writing about a company that’s doing something similar in Japan’s budget hotel industry (without the rap, unfortunately). The company is Kyoritsu Maintenance, which operates the popular Dormy Inn hotel chain.

Dormy Inn has been in a constant state of room undersupply, thanks to the brand’s immense popularity. For years, it was a “best-kept secret” among Japanese travelers. But as foreign tourists have caught on to its superior value, demand has surged.

This fiscal year, Dormy Inn’s net sales are projected to be 80% higher than pre-Covid levels. It’s performing so well that the company is on track to meet its 2028 sales target (for the Dormy Inn segment) by 2025, three years ahead of schedule. Dormy Inn has maintained an occupancy rate between 80-90% (except for during Covid), consistently 10-20 percentage points above the industry average.

For a while now, I’ve been on the lookout for an attractive play on Japan’s booming tourism industry. Finding one with a combination of growth and reasonable valuation has been difficult, but Kyoritsu stands out. After studying the business and actually spending three nights at one of their hotels in Japan, I’m convinced this one is a gem.

Company history — An unconventional start

Kyouritsu Maintenance didn’t start as a hotel business. Founder and current Chairman Haruhisa Ishizuka started the business in 1978 offering outsourced meal preparations (“Kyushoku”) for corporate canteens. In 1980, the company expanded into the dormitory business, managing college and corporate dormitories. Back then it was more common for Japanese companies to provide dormitories to new hires, and Kyoritsu managed dormitories as an outsourced partner.

Kyoritsu was very good at this and earned a strong reputation among clients. Corporate employees asked whether they can also stay at Kyoritsu-managed properties while on business trips. This demand led to the creation of the Dormy Inn hotel brand in 1993 (the name Dormy Inn comes from Dorm + Inn), with the goal of offering a hotel experience that felt as cozy as staying in one’s own dormitory.

Dormy Inn initially started as a “business hotel,” mainly serving Japanese businessmen on domestic trips. Major competitors in Japan’s business hotel category include APA Group, RouteInn, Toyoko Inn, Super Hotel, and Washington Hotel.

Typically, Japan’s business hotels are budget accommodations focused on efficiency. They offer a basic room and a bed for a quick overnight stay. After late nights out with clients, businessmen would simply return to their rooms to sleep. These hotels were not known for their comfort or service.

That is, until the arrival of Dormy Inn, which pioneered the concept of making business hotels an enjoyable stay. In a commodity business, Dormy Inn emerged as a differentiated player with a distinct brand and a loyal fanbase. Dormy Inn grew via word-of-mouth as more and more business travelers caught on.

If the first phase of Dormy Inn’s growth was driven by business travelers, the second phase saw its expansion into leisure and family travel. Businessmen who stayed for work started choosing Dormy Inn for family vacations too. Today, Dormy Inn is in its third phase of growth, driven by foreign tourists drawn to its superior value.

Dormy Inn is famous for its unconventional services (which we’ll explore throughout this report). Management credits much of this creativity and out-of-box thinking to the company’s unconventional origins of having not started in the hotel industry. For instance, guests are encouraged to roam the hotel property in pajamas provided (like in the picture below), much like students in a dormitory, creating a relaxed and at-home environment.

Dormy Inn

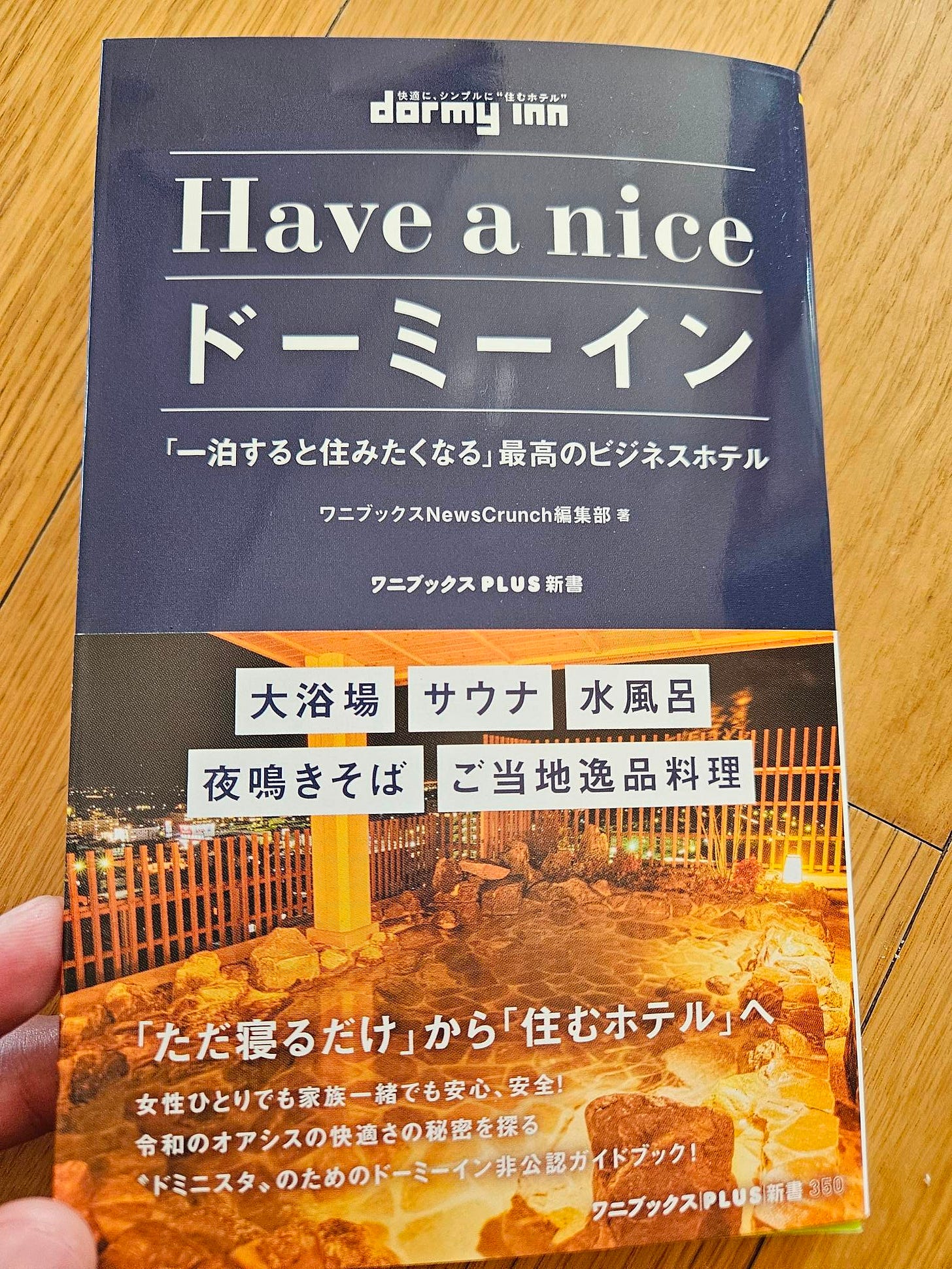

I picked up the below guidebook on Dormy Inn. What’s special is that it wasn’t written or sponsored by the company. It was written by a group of self-proclaimed fans who share what they love about Dormy Inn and offer tips on how best to enjoy a stay there. The authors disclose that they are independent from Dormy Inn and received no compensation from the company for writing it (find me a fan-made book like this on Hilton or Marriott)

It’s clear that people love Dormy Inn. But what makes it special?

There are three features which are considered hallmarks at every Dormy Inn location: Japanese-style communal bath, delicious breakfast, and free late-evening ramen service.

The communal bath is undoubtedly the flagship offering at any Dormy Inn location. As most readers know, bathing culture is huge in Japan (Furo or Onsen). Dormy Inn’s communal baths are of such high quality that it has become synonymous with the hotel brand.

The bath uses real hot spring water, transported by trucks from natural sources. The Japanese are truly serious about their baths! There is even a third-party water analysis certificate showing the exact water source and its mineral composition.

The baths are beautifully designed using high quality material. Some locations even feature robenburo (open-air baths on terraces or balconies). There is great attention to detail, such as showers equipped with pressure-adjustable shower heads and change rooms equipped with premium hair dryers.

Guests also love the fact that Dormy Inn’s baths stay open throughout the night until 10am the next morning (competing hotel chains that offer baths typically close them at midnight).

After a soak, guests can relax in the lounge area, which offers ice cream, probiotic drinks, and massage chairs—all for free.

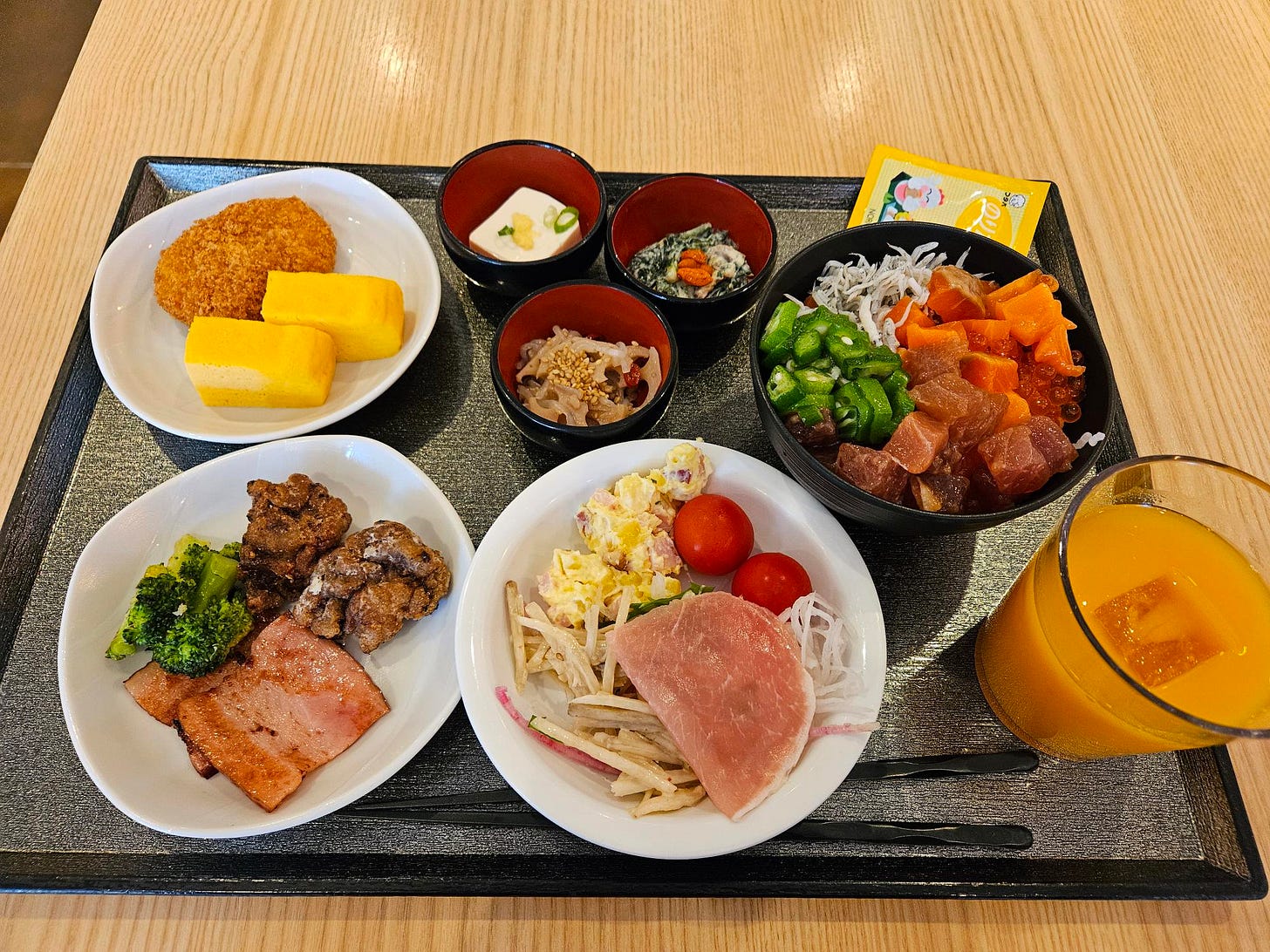

Dormy Inn’s second most famous offering (after the communal bath) is its legendary Japanese-style breakfast.

Prices vary by location but generally range from ¥2,000-2,500 for the all-you-can-eat breakfast.

Each Dormy Inn location features a signature local dish from the region (this reminds me of Atour in China, which I wrote about in June).

Perhaps what made Dormy Inn’s breakfast most famous is the all-you-can-eat kaisendon available at many locations. Guests can pile as much sashimi as they like onto a bed of rice (with some locations even offering fresh scallops, salmon roe, and real crab meat!)

According to management, the profit margin on breakfast is “very slim.” Once you experience it, you might find that to be a generous statement.

A picture is worth a thousand words, so here are some images of the breakfast.

This is from my own stay at Dormy Inn Wakayama. The Kaisendon features cubed tuna and salmon sashimi pickled in soy sauce, with white anchovies, which are apparently a Wakayama specialty. The fried item in the bottom left dish? That’s not chicken karaage. It’s fried whale meat (tasted like a chewier version of beef).

Finally, another service that has made Dormy Inn famous is its signature late-evening ramen service (“Yonaki soba”)

Between 9:30 to 11pm, guests can enjoy a complimentary bowl of freshly made ramen (reminds me of Atour’s evening congee and dim sum service in China).

This is served in the same restaurant as the breakfast. In the evening the space transforms into a lounge where guests can gather for a light meal and have tea with their families and friends.

Brands under the “Dormy Inn segment”

There’s some room for confusion here because Dormy Inn is the name of the specific hotel brand, but also refers to the company’s operating segment (“Dormy Inn segment”.)

Within the Dormy Inn segment, there are actually four sub-brands. As of March 2023, the Dormy Inn segment operated 91 hotels, broken down as follows:

Dormy Inn (53 locations)

Dormy Inn Premium (18 locations)

Dormy Inn Express (9 locations)

Onyado Nono (11 locations)

Among these, Onyado Nono (御宿 野乃) deserves special mention, as it’s the fastest-growing sub-brand within the segment. Think of it as a slightly more upscale Dormy Inn, featuring “Japanese style” rooms (similar to those of traditional Japanese style inns or Ryokan), primarily catering to tourists.

Ryokan accomodations offer a traditional Japanese experience but are often located in rural or less accessible areas. Onyado Nono bridges this gap by providing the authentic ryokan experience in city-center locations at more affordable rates than full-service ryokans, which has made it particularly appealing to tourists. Onyado Nono is the most premium offering within the Dormy Inn segment, and it’s typically priced at something like 10-30% premium over standard Dormy Inn hotels. But depending on the location and dates, the premium can get to as high as 50-100%.

Business economics

It’s now time to dive into the numbers.

Revenue

Capacity

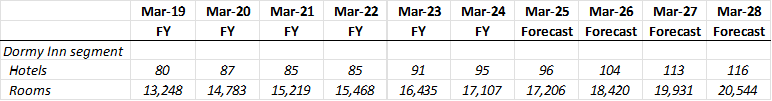

The company’s expansion plans for the Dormy Inn segment are shown below.

By March 2028, the Dormy Inn segment will operate 116 hotels (vs. 91 in March 2023). Room capacity is expected to reach 20,544 (vs. 16,435 in March 2023) representing an annual growth of 4.6%. This expansion includes:

Dormy Inn (63 locations, up from 53)

Dormy Inn Premium (19 locations, up from 18)

Dormy Inn Express (15 locations, up from 9)

Onyado Nono (19 locations, up from 11)

The projected growth rate of 4.6% appears conservative to me. In the last five years, room capacity expanded by 5% annually, even throughout Covid. Japan’s tourist arrivals should comfortably exceed this going forward. In the month of September 2024, visitor arrivals was up 31% YoY and 26% compared to the same month in 2019. At an expansion rate of 4-5% the company should have no problem maintaining high occupancy and pricing, especially considering the current state of undersupply.

In fact, the question is why aren’t they expanding capacity faster. The answer likely lies in their asset heavy model which demands significant capex. This approach, while ensuring control over properties and consistent quality, can limit the pace of expansion (more on this later).

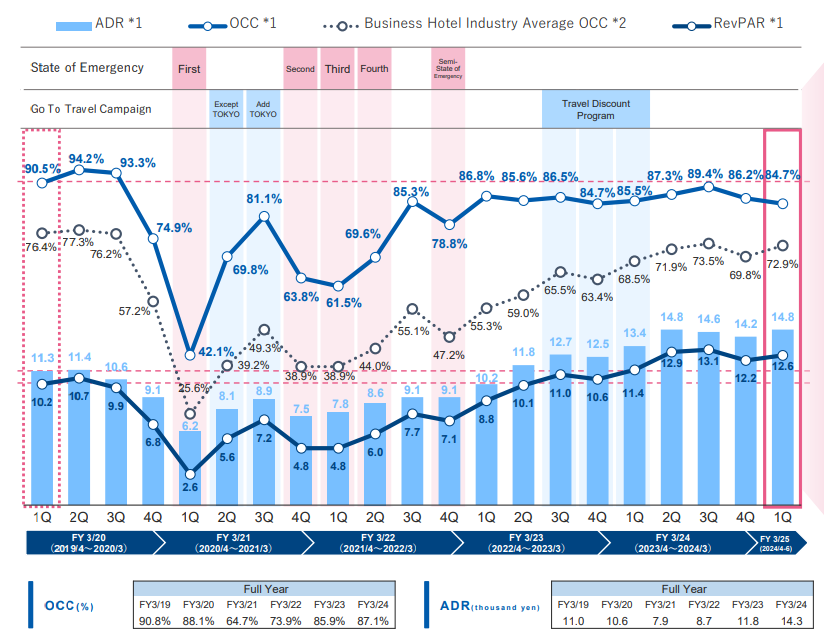

RevPAR

RevPAR (Revenue per Available Room) is a key metric in the hotel industry, calculated by multiplying occupancy rate by ADR (Average Daily Rate). The trend is shown below, illustrating steady growth in RevPAR driven by consistent increases in ADR while maintaining a high occupancy rate.

Occupancy

For the past nine quarters occupancy has trended in the 85-89% range, indicative of undersupply. For context, the average occupancy rate in Japan’s business hotel industry is roughly 73%, and historically Dormy Inn has enjoyed occupancy rates 10-20 percentage points higher than the industry average.

In my view, this high demand is the result of the Dormy Inn brand being in a unique sweet spot as it appeals highly to both foreign tourists and Japanese travelers alike. Foreign visitors appreciate the authentic Japanese experience, and many are just beginning to discover that Dormy Inn offers a differentiated, better-value alternative to other hotels at similar price points.

Meanwhile, demand from Japanese guests remain strong, particularly in recent years due to Japan’s economic environment. The weak yen has led to fewer Japanese traveling internationally, with many opting for domestic trips instead. Also, with the inflation and decline in purchasing power, Dormy Inn is likely benefitting as Japanese guests seek more value-oriented options, trading down from full-service hotels.

ADR

Dormy Inn has consistently grown its ADR since bottoming in Covid. The current ADR at ¥16.1k (as of Q2 FY3/25) compares to pre-Covid peak of ¥11.4k, marking a 7.1% annual pricing growth. But occupancy is currently 87% (Q2 FY3/25), down from 95% pre-Covid. Despite lower occupancy today, ADR is 40% higher! This suggests pricing increase is not just cyclical, but rather reflects a permanent ability to pass on higher prices as Dormy Inn is able to capitalize on its brand value.

It’s worth noting that prices can fluctuate significantly during the week, with tourism peaking on Friday and Saturday nights. I have seen Dormy Inn Premium at popular locations selling out completely at ¥25-30k per night on these days. On weekdays, when there are fewer tourists and more local business travelers, prices can sometimes drop to ¥10k or below especially in more rural locations.

Simply put, foreigners are willing to pay much more than Japanese guests. If tourism continues to grow, the gradual crowding out of Japanese travelers seems inevitable. Already, in popular areas like Tokyo, Kyoto, and Osaka, room rates are high year-round, and these locations are seeing fewer Japanese guests. Business travelers, for instance, are often unable to stay at Dormy Inn in these locations due to their corporate budgets which are typically capped at ¥10k per night (¥8-9k for more junior employees) for domestic travel.

This dynamic also shows the pricing upside if tourism continues to grow and the crowding out of Japanese guests continues. It’s not hard at all to imagine ADR rising to ¥20k and beyond. We’ve already started to see some locations fully booked out at much higher rates.

Margins

In 1H, operating margin at the Dormy Inn segment reached an all-time high of 21%. I think there is still room to expand further, driven by:

Increase in direct bookings through the membership program; and

Pricing increases

In FY3/24, only 18% of hotel bookings were made directly through the company website. By 2028, the company aims to increase this to 40%, which would boost profitability by reducing commissions paid to travel agencies. 40% seems like a reasonable target, given successful hotel groups globally have achieved direct booking rates in the 50-60% range.

A key driver for achieving this is Dormy’s, the company’s membership program, which was introduced in December 2022. Yes, you read that right — Dormy Inn didn’t have a membership program until then (crazy, right?) Guests had long been asking when Dormy Inn will finally launch a loyalty program. They finally delivered.

If you’re wondering what took them so long, I think there are two reasons:

Management says they wanted a membership program that would not be just for Dormy Inn but integrates across the company’s other facilities, which took time to coordinate.

But honestly, I think the real reason is simply that Dormy Inn had such a loyal customer base and offered such high value that they didn’t need a loyalty program to keep guests coming back.

Management will also continue to raise prices (management likes to say “normalize prices” instead, which is just a nicer way of saying the same).

With so much freebies and perks provided to guests, management has plenty of flexibility to either charge more or reduce costs to drive profitability. In this case, they’ve indicated a preference for raising prices rather than cutting costs to avoid negatively impacting service quality and the brand value, which I think is the right call.

Putting it together

Here are my assumptions:

Annual capacity growth of 4.6% (as per management guidance)

RevPAR growth of 5% (assuming no change in occupancy rate and a 5% increase in ADR, compared to 7.1% they achieved in the last five years,) and

Operating margin expansion of 1-2 percentage points per year.

This results in a topline growth rate of about 10% and a profit CAGR of 15-20%. Depending on the margin assumption, profit growth could vary significantly, but I think we should be reasonably looking at mid-teens profit CAGR for the next several years for the Dormy Inn segment.

To be continued in Part 2…

Disclosure: The author owns shares in Kyoritsu Maintenance