Digital Garage Inc (4819)

Riding the wave of Japan's cashless payments growth

Why is this interesting?

Japan, traditionally reliant on cash, is rapidly embracing cashless payments. In 2022, cashless adoption reached 36%, with the Japanese government setting a target of 80%. Cashless transactions are expected to grow 8-10% annually, with some forecasts suggesting even higher rates.

The question is: what’s the best way for public market investors to capitalize on this trend?

I believe Payment Service Providers (PSPs) are the prime beneficiaries and offer one of the best exposures.

PSPs enable merchants, both offline and online, to accept various cashless payment methods, including credit cards, mobile payments, and others.

They are indispensable partners for merchants, acting like toll gates for cashless transactions.

There are scale advantages in this business, which is why the top three players (GMO Payment Gate, SB Payment, and Digital Garage) account for more than 70% of the market and will continue to consolidate it.

Within this sector, my top pick is Digital Garage. The company is highly undervalued. Its payments subsidiary, Digital Garage Financial Technologies (DGFT), alone is worth the company’s entire market cap of ~120 billion yen. The company also holds a large amount of financial assets, including a venture capital portfolio and a 20.35% stake in publicly listed Kakaku.com.

Overall, Digital Garage is trading at a 40-50% discount to my estimated combined NAV of 200-240 billion yen.

There are signs that management is willing to address the discount. They have indicated plans to downsize the venture capital portfolio and shift focus to managing external capital. Management has also sold off a small stake in Kakaku recently. More capital being freed up and used to boost shareholder returns could unlock value.

Activist pressure could also accelerate this timeline. Engagements with activists including Oasis and AVI have resulted in some positive changes, and future interactions may result in more shareholder-friendly actions being taken.

Japan’s cashless payments landscape

Japan has historically lagged in adopting cashless payments, but it has been steadily catching up.

There are two main drivers for the increase in cashless transactions:

Growth in online shopping.

Increased use of cashless payments for offline transactions.

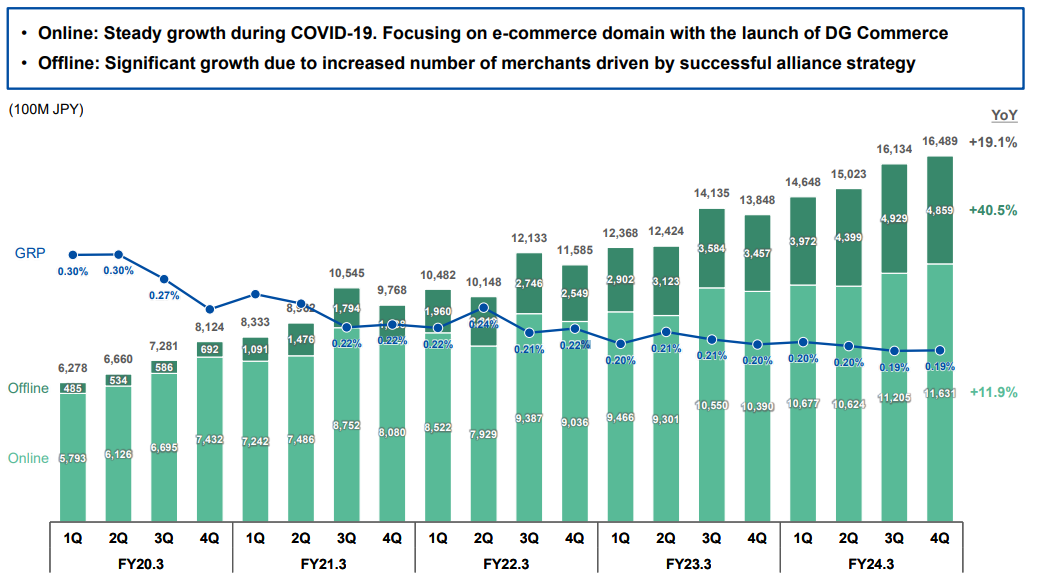

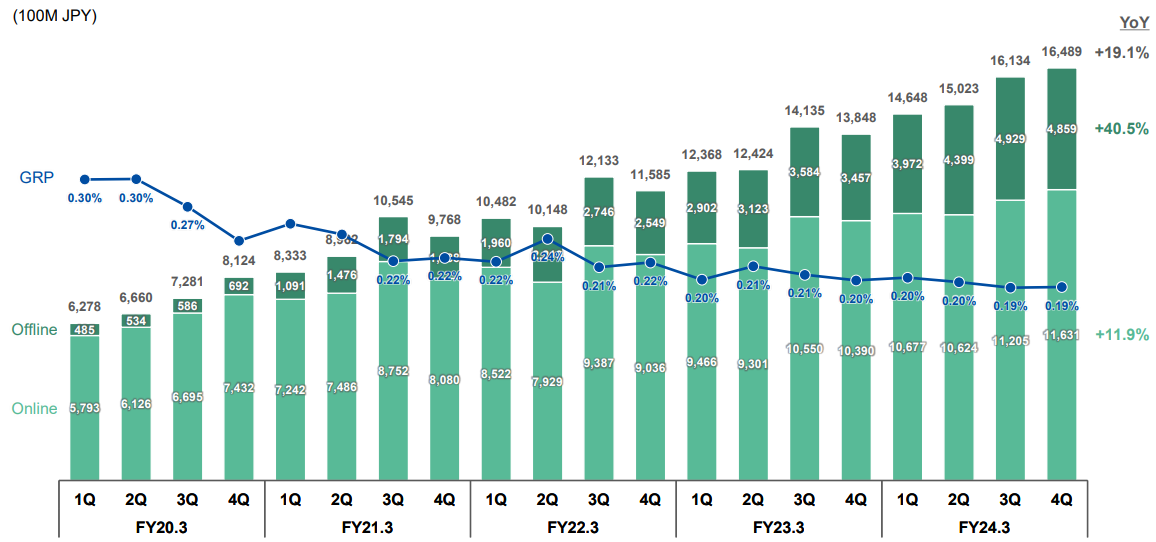

The breakdown of DGFT’s transactions shows that while online transactions continue to grow, offline transactions have been the main driver of cashless payments growth in recent years.

Regular visitors to Japan may have noticed this change. Five years ago, cash was still widely used at convenience stores and restaurants. However, during my visit to Japan in March, I saw firsthand that cashless payments have gained significant traction at offline venues, especially compared to pre-COVID times.

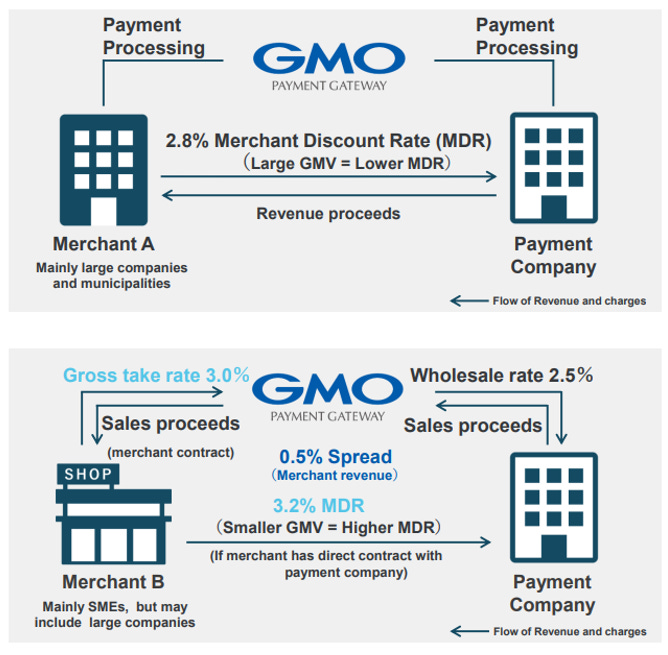

Understanding the cashless payments value chain can be confusing due to the various players involved. The diagram below (source: GMO PG) shows how the pie is split in Japan.

International brands: Visa, Master Card, American Express, etc.

Issuers: Entities (mostly banks) that issue cards to consumers. Issuers capture a large share of the pie due to their significant consumer acquisition and marketing expenditures (e.g. providing points and benefits).

Acquirers: Work with the international brands, representing them in specific locales with the goal of acquiring merchants. Sometimes, acquirers are also issuers — for example, the megabank groups perform both roles.

Payment Service Providers (PSPs): Help merchants accept various payment methods and provide the software and infrastructure for processing transactions.

One might ask, what is the difference between acquirers and PSPs? The best way to think about this is that PSPs are like agents for merchants, while acquirers are like agents for international brands. They serve different masters.

So the question then becomes — how do PSPs serve merchants and what value do they add?

The value propositions of PSPs

What’s unique about Japan’s cashless payments landscape is that it’s extremely fragmented. The image below shows all the different payment methods accepted at a Seven Eleven store (39 payment methods!)

There are five major credit card brands (Visa, Mastercard, AMEX, JCB, Diners Club). In addition, a myriad of mobile payments is offered by both Japanese companies (Rakuten, LINE, PayPay) and foreign companies (Google and Apple). Telecom companies have their own payment methods (au Pay, docomo pay). There’s also prepaid e-money like Rakuten Edy, Pasmo, and Suica. To accommodate the increasing number of foreign tourists, there are Alipay, WeChat Pay, and Kakao Pay.

How do merchants accept and interface with all these different payment methods? This is where the PSPs come in.

One-stop “plug and play” solution

One of the key value propositions of PSPs is offering merchants a “plug and play” solution for all these payment methods. A merchant that doesn’t work with PSPs would have to individually negotiate and sign merchant agreements with each payment provider. This process is time-consuming and simply impractical for most merchants, especially in a market like Japan.

PSPs offer merchants a single point of contact for all payment-related needs and troubleshooting. This streamlines operations, reduces time spent on managing and invoicing payment networks, and simplifies the entire payment process.

Aggregator

But PSPs do even more — they act as aggregator of merchants, leveraging the scale of their network to negotiate for improved Merchant Discount Rates (MDRs) with acquirers. This gives merchants better rates than they could negotiate on their own.

Here’s a simple example. A small merchant might be quoted a 3.2% MDR by an acquirer, while a large merchant might get a 2.8% MDR. Large PSPs, however, can negotiate a 2.5% MDR due to their aggregated scale. The PSP might take a 0.5% spread as commission, which means merchants will pay 2.5% + 0.5% = 3%. This is still cheaper than the 3.2% that the small merchant could get on its own.

Payments infrastructure (software)

PSPs serve as a key part of the payment infrastructure. They handle the interface between merchants and the relevant payment networks.

For example, they capture customer payment information at the Point of Sale (POS) and securely route it to the appropriate network (Visa, Mastercard, etc.) When the transaction is verified by the issuer, PSPs send authorization responses back to the merchants, relaying whether the transaction is approved or denied.

Adjacent service offerings

Importantly, in all of this, PSPs handle payment data. Payment data is valuable and can be used for a variety of purposes. Leveraging this access to data, PSPs also offer adjacent services to merchants, including financial services such as working capital loans and Buy Now, Pay Later (BNPL), as well as digital marketing services. By using their payment services as a foot in the door, PSPs have expanded into these adjacent services.

As you can see, PSPs are indispensable to merchants in the payments ecosystem.

Competitive landscape

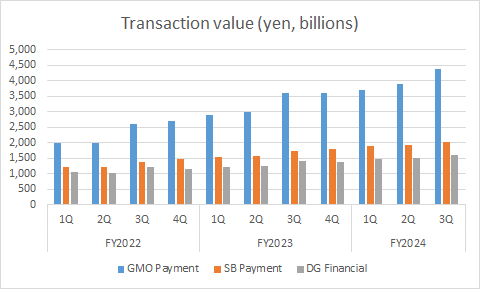

The top three PSPs in Japan account for more than 70% of the market share and have been consolidating the market.

All three players have grown significantly, as shown above. GMO Payment Gateway, the #1 player, has grown the fastest, achieving a CAGR of over 30% in transaction value. SB Payment and DGFT have grown at CAGRs of 21% and 15%, respectively.

In recent years, cashless transactions in Japan have grown at a rate of 10-15% annually. This indicates that GMO has been taking a significant share, SB Payment has been gaining some share, while DGFT is growing roughly in line with the market and maintaining its share. The smaller players in the industry are the losers.

GMO Payment Gateway is undeniably the strongest player. They have both the brand name and scale, including significant sales resources. They are also pioneers in providing total solutions, offering a wide range of financial credit and loan products to support merchant operations. DGFT is playing catch-up in this area, such as its recent acquisition of Score Co. to bolster its BNPL offerings.

SB Payments is affiliated with SoftBank, and its main strength is doing business within the SoftBank ecosystem, where others have a hard time breaking in. Given the reach of the Softbank ecosystem, this makes SB Payment a tough competitor.

So, how does Digital Garage compete against these bigger players? One of DG’s clear weaknesses as the third player is its smaller scale. Past expert calls have highlighted that their weaker growth is partly due to the limited size of their salesforce.

Despite this, Digital Garage’s management remains optimistic.

They project 20% growth in pre-tax income for the payments business and 20-25% for the PS segment as a whole (which includes marketing solutions in addition to payments).

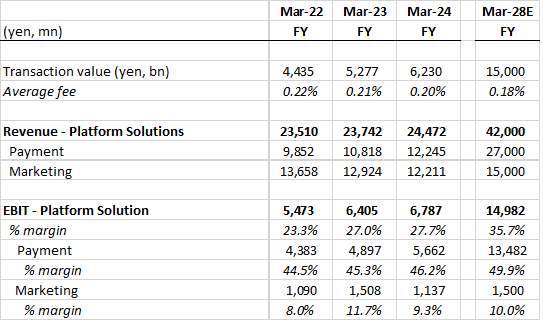

Management expects transaction value to reach 15 trillion yen by FY3/2028, up from 6.2 trillion yen last year.

How will they achieve this? A notable recent trend is that Digital Garage has leaned on partnerships to overcome their scale disadvantage. Two particularly interesting partnerships are Resona and KDDI.

Resona

Resona now owns 12% of Digital Garage as part of the equity alliance formed in December 2023, indicating the significance of the partnership. The two also established a joint venture called Resona Kessai Service, a payment solutions company where Digital Garage will white-label its PSP service to the JV (in addition to owning 20% of the JV).

As the 5th largest bank in Japan by assets, Resona is a powerful partner. Digital Garage will benefit in two ways. First, by leveraging Resona’s vast client network (500,000 companies) and sales network (3,000 professionals and 800 branches). Second, Resona can help bolster financial services offerings for merchants, helping them better compete with GMO.

This partnership with Resona also extends to Digital Garage’s venture capital business, which we’ll discuss later.

KDDI Group

The partnership with KDDI was recently announced in May 2024.

KDDI is Japan’s #2 telecom company, and Digital Garage has partnered with them to provide payment services for the “au” economic zone (KDDI’s mobile plan brand), which boasts 34 million “au” Pay members and 12 trillion yen in transaction value.

This partnership may be a response to SB Payments, which has the captive SoftBank economic zone. KDDI is an excellent partner, not only because the “au” economic zone is huge, but also because they are ambitious about diversifying into non-telecom businesses (for example their recent acquisition of convenience store Lawson).

There should be many payment business opportunities for Digital Garage to pursue in partnership with KDDI.

Obviously, the devil is in the execution. However, I believe these partnerships with large, well-established players can be game changers for Digital Garage, helping it overcome its smaller scale and compete more effectively with larger PSPs.

Barriers to entry

At first glance, there are many PSPs which might suggest that the industry suffers from low barriers to entry. However, the industry is consolidating for a reason — because scale matters.

In this business, dealing with merchants requires substantial on-the-ground sales and support functions.

Another crucial factor is information security, as PSPs handle customer payment data. The fear of data breaches is a major concern for merchants, with many companies suffering reputational damage after being hacked or losing customers’ personal information. Therefore, the biggest PSPs, which are trusted for their security, tend to get more business.

Scale also offers advantage in terms of the payment provider network. Smaller PSPs struggle to sign up as many payment providers and do not secure as favorable merchant discount rates.

That said, I don’t believe this is a winner-take-all market either. Competitive pressure exists as merchants shop around for the best fees, usually among the top three PSPs. If we look at both the acquirer and international brand spaces, they tend to have around three major players as well.

What about foreign payments players entering Japan?

Large foreign players like Adyen have a presence in Japan but focus on existing enterprise relationships. For example, Amazon Japan and Microsoft Japan are their customers. They find it challenging to penetrate the SME space due to the need for an extensive on-the-ground salesforce and support.

In fact, Digital Garage supports the market entry for 12 global payment companies, including Adyen, Worldpay, and dLocal, through partnerships. This demonstrates that foreign players prefer to integrate with DG’s established network rather than build their businesses in Japan from scratch.

Business economics

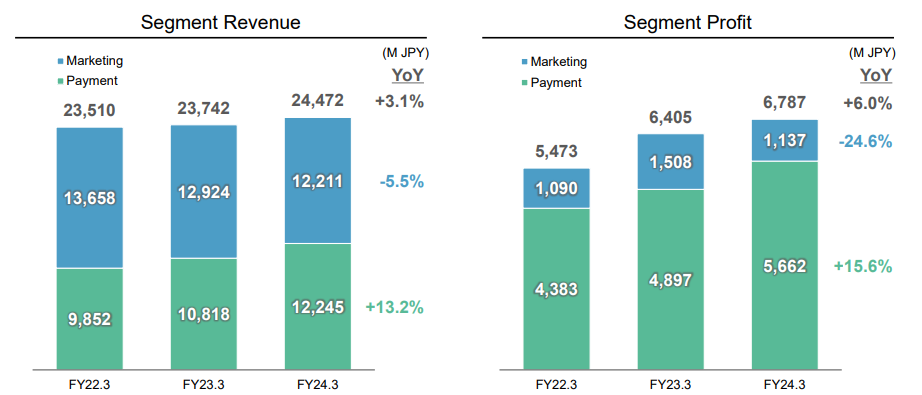

Digital Garage breaks down its Platform Solutions (PS) segment into payment and marketing services. The payments segment is much more profitable, earning a 46.2% operating margin and accounting for 83% of the segment's profit, as shown above.

I expect margins to continue growing, driven by operating leverage. As cashless payment adoption increases, existing customers keep increasing their transaction values. This results in very high incremental margins for Digital Garage, as there are minimal costs associated with servicing greater transaction volumes from existing customers.

While the average fee has been on a downtrend—now at 0.19% (shown by the blue line below) —I don't think this is a big issue.

Japan’s cashless transaction market is far from mature. Fees have always been in decline, but PSPs have significantly grown their sales and profits thanks to transaction volume growth.

The industry is past the phase of the largest declines. Fees have stabilized around the ~0.20% range over the past two years. While the general declining trend might continue, it will likely be modest as industry consolidates.

Another reason fee erosion has been modest is the shift to the “full service model,” which has effectively increased pricing. We discuss this next.

Revenue model

There are two PSP service models: “partial service” (sometimes called direct contracting) and “full service” (representative contracting).

It's actually quite simple—merchants can use PSPs as a one-stop-shop to handle everything (full service model), or merchants can sign their own agreements with payment networks and only use PSPs for their payment infrastructure/software (partial service). The first diagram below shows the partial model, and the second one shows the full model.

Don't worry if the charts are a bit confusing. Here's what you need to know: PSPs make more money under the full service model, and the shift towards this model has been a pricing tailwind.

Under the partial service model, PSPs earn only a fixed commission of 3-5 yen per transaction.

Under the full service model, PSPs make a spread income plus the fixed commission. For instance, they earn 50 basis points plus 3-5 yen per transaction.

Typically, very large merchants with in-house resources might only use PSPs for infrastructure (partial service) to save costs, but most SMEs can't do this. They need full support from PSPs. As more and more smaller businesses in Japan have to accept cashless payments, we are seeing the mix of full service models increase.

This transition clearly shows that the value proposition of PSPs is being realized. PSPs are capturing more value in the payments value chain.

For example, at GMO, the full service model accounts for 43%, while the partial model accounts for 57% of revenue. Ten years ago their full service model was only at the 20-25% level. Digital Garage doesn’t disclose these numbers, but the trend is likely similar.

Other parts of Digital Garage

When valuing Digital Garage, there are three main components:

Payments business

Venture capital investment portfolio

Stake in publicly listed Kakaku.com

We’ve covered the payments business, so let’s go over the key points on the VC portfolio and Kakaku.com. See footnotes for brief comment on their accounting treatment12

Venture capital investment portfolio

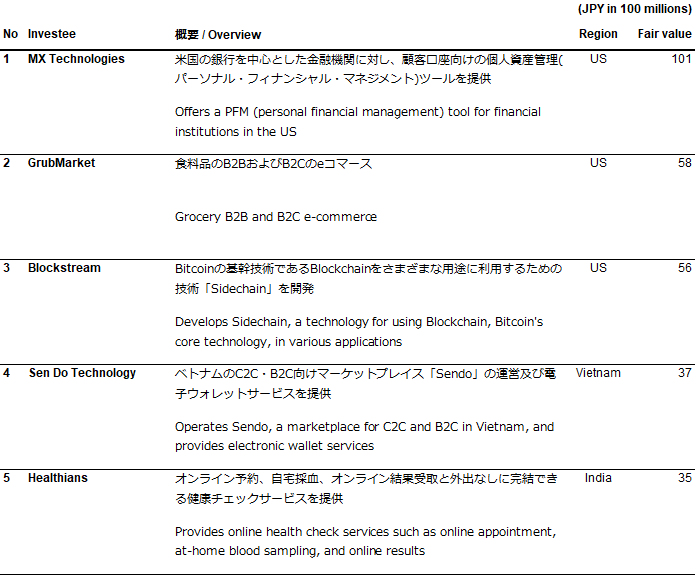

Digital Garage has invested in 200 early to late-stage startups, with a fair value on the balance sheet of 70 billion yen as of March 2024. The distribution of investments is 43% in North America, 24% in Asia, and 18% in Japan. The top five investments make up about 40% of the portfolio’s value and are shown below.

I have no opinions on these individual businesses. But it’s interesting that none of these investments are in Japan. And given that most investments are outside of Japan, one might question what kind of edge Digital Garage has as a Japan-based VC.

If anything, I personally lean towards being skeptical of Digital Garage’s capability as VC investors. However, this is becoming less relevant as the focus on VC investments is diminishing. On one hand, the fast growth of the payments business leads to a natural business mix shift away from VC. On the other hand, management is also pulling capital away from investments.

Management has commented that “Investment balance is expected to gradually decrease in five years due to cash generation by investment exit and strategic selection of new investees”. Let’s be honest, ‘strategic selection’ is just investment speak for “oops we screwed up”.

Until now, Digital Garage has focused on using its own capital to invest in startups (76% of investments is using its own capital, according to activist Oasis). Moving forward, they plan to use less of their own capital and more of other people’s money, i.e. developing the VC fund management business.

For example, they have partnered with Daiwa and Resona, which provide a good source of external capital. Given the lack of VC talent in Japan, these Japanese banks likely see value in partnering with DG. This strategy is similar to that of competitor Jafco, another prominent Japanese VC, which has shifted from using its own balance sheet to managing external funds.

These external funds also serve as an exit strategy for Digital Garage. Recently, the company has been transferring a portion of its balance sheet investments into the new DG Resona Venture Fund, a 10 billion yen fund set up jointly with Resona (50/50).

Kakaku.com

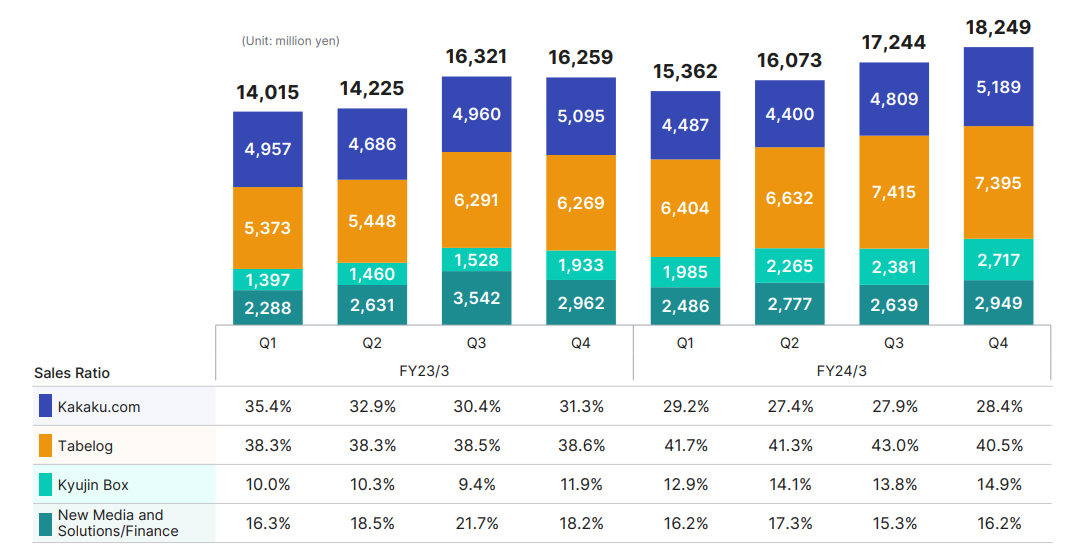

Digital Garage acquired a 45% stake in Kakaku.com in 2002. Kakaku.com is a pioneer in Japan’s online price comparison space. Its first business was the price comparison website Kakaku.com, but since then, it has grown into a diversified consumer online media company operating in several verticals.

Kakaku.com started with price comparisons for home electronics but has since added new categories, including services. Service categories now contribute more to revenue than goods and include personal finance (credit cards, loans, investments) and telecom services (phone plans, internet providers, etc.). Although this business has been mature for a while, it has proved to be quite resilient given its ability to continually expand into new category offerings.

Tabelog is Japan’s largest restaurant review website and booking platform, boasting 93 million monthly users. It monetizes mainly through restaurants paying to promote their listings and take online reservations. The business has been growing due to increased dining out post-COVID and inbound tourism.

Kyujin Box is basically the Indeed of Japan — a job listings aggregator. It’s growing fast, although still about 1/7th the size of Indeed’s business in Japan.

Some concerns remain about Kakaku’s future. For example, Japan is focused on building out large consumer points ecosystems, which might make price comparison less relevant in the future as consumers become more loyal to specific ecosystems.

Although Kakaku.com is a great company, it has generated no synergy with Digital Garage. There is no evidence that Kakaku.com benefits in any way from Digital Garage’s ownership. In my view, minority shareholders would be better served if Digital Garage positioned itself as a pure-play payments company. This would involve selling or spinning off Kakaku.com and the VC portfolio.

The good news is that in November 2022, management sold part of their Kakaku.com shares (a 3.4% stake), signaling a willingness to potentially reduce their stake over time.

Valuation and catalysts

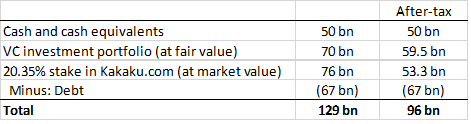

At 2,500 yen per share, Digital Garage’s market cap is ~120 billion yen.

The following table shows the value of the company’s financial assets:

The right column shows the value after a capital gains tax (30%) is applied on the Kakaku stake and the investment portfolio. The cost base assumptions are as follows:

Digital Garage paid 800 mn yen to acquire 45% stake in Kakaku.com in 2002.

We don’t know the cost base for the investment portfolio, but let’s assume it’s 50% of the fair value.

We can see that the financial assets alone are worth almost Digital Garage’s entire market cap, giving little value to the payments business.

How much is DGFT worth?

The key assumptions for FY3/2028 are:

15tn yen in transaction value, as guided by management.

Average fee of 18 basis points.

53% incremental EBIT margin on payments business (consistent with historically).

With these, I see the payment business delivering 13.5bn of EBIT at 50% margin in FY3/2028. We can also assume a modest growth in the marketing business to arrive at ~15bn in total segment EBIT.

Assuming the business is mature at that point, valuing it at 10x yields 150bn. Discounting this back to today at 8%, the business is worth 110bn. This is 16x last year’s EBIT.

Now, competitor GMO Payment Gate generated 20 bn of EBIT and has market cap of ~600 bn, which is 30x EBIT. Global peers Adyen and Block also trades at 30-40x EBIT, so we know the market is willing to value fast-growing payments businesses at high multiples. Perhaps it shows the upside for DGFT if it were to be recognized as a payments pureplay and can also grow faster.

Digital Garage’s market cap is 120 bn yen, while I believe its NAV is easily worth north of 200 bn.

Catalysts

I believe management is increasingly conscious of helping shareholders narrow this discount. Their plans to downsize the venture capital portfolio, as well as the recent sale of a small stake in Kakaku.com, all point to this. They have also acknowledged the importance of shareholder distribution. While I can’t comment on the magnitude or how soon this will happen, I think they are heading in the right direction.

Activist pressure could also accelerate this timeline.

What’s notable is that historically, Digital Garage has shown receptiveness towards activist proposals. For example, they have integrated the old FT (payments) and MT (marketing) segments into Platform Solutions and shifted focus away from own-balance sheet investments to external capital management.

Oasis is further proposing that the company spin off into two entities: Fintech and Investments, while divesting Kakaku.com entirely and boosting shareholder returns.

This would allow DGFT to be recognized by the market as a pure-play payments company, with its growth no longer overshadowed by the volatility of the investments business, leading to value being unlocked.

To summarize the thesis on Digital Garage: The company operates a growing and profitable payments business, is statistically undervalued, and has potential catalysts that could drive the stock price much higher if they materialize.

Disclosure: The author holds a long position in Digital Garage

Venture portfolio is recorded as “operational investment securities” under current assets, marked to fair value every quarter. Historically most of gains/losses here came from valuation changes rather than on investment sales/exit. It can be lumpy, which is why I don’t recommend investors look at the company’s income statement as it obfuscates the payment segment results.

The stake in Kakaku is recorded as equity method holdings under non-current assets at cost base. The accounting here is bizarre - equity method earnings from Kakaku is recorded as revenue for Digital Garage (Kakaku is classified as part of the “Long Term Incubation” business segment). Again, ignore the income statement as it’s a gigantic mess! Sum-of-the-parts is the best way to value the business.