Coupang: Why I'm sitting out

Competitive and political risks are being underestimated

“I got charmed by the idea of their position in the Chinese internet; I didn't stop to realize they're still a god damn retailer.”

- Charlie Munger, reflecting on his Alibaba investment

Coupang is Korea’s leading e-commerce retailer. It operates an asset-heavy model and is known for its fast delivery time and customer-obsessed culture. As the clear winner in Korean e-commerce in recent years, it has become a favorite among Wall Street and foreign investors.

Why am I writing this? As someone who lives in Korea and uses Coupang almost daily, I thought I’d share insights from my dual perspective as both a user and an analyst. I remain a happy user of Coupang. But I have a different opinion on the stock.

In my view, two things are underdiscussed among foreign investors: competitive risk and political risk. On the first one, most write-ups on Coupang that I’ve come across only touch on Korean competitors like Naver and 11Street. No one talks about Aliexpress as the dark horse. On the latter, there has been virtually zero mention whatsoever.

My main points are as follows. The rest of the write-up will unpack each of these points.

Chinese platforms pose a genuine threat, resulting in fundamental changes to the Korean e-commerce landscape.

The Chinese are also more strategic than investors might think (particularly AliExpress) and have long-term ambitions in the Korean market.

The bullish case for Coupang today requires government intervention that’s strong enough to stifle the Chinese players. But here, I remain somewhat skeptical.

In my view, Coupang is almost certain to face significant domestic political risks in the long term.

I’m not saying you should short it. But I don’t see how Coupang is an attractive long-term investment from here.

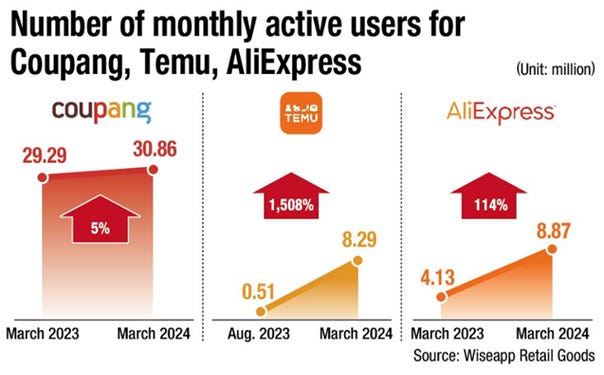

Aliexpress and Temu have grown rapidly, as shown above, and their monthly active users are each now around a quarter of Coupang.

I believe the Chinese players (Aliexpress especially) are a real competitive threat. Let me be clear - I’m not saying Coupang is “screwed” in an absolute sense. However, there needs to be a reassessment of Coupang’s TAM, long-term growth rate, ability to make a profit, and ultimately, the multiple that the market assigns to the business.

I would bring up China’s JD.com here. It operates a similar model to Coupang, with an asset-heavy model leveraging in-house logistics and delivery infrastructure. Users love JD for the delivery speed and quality of customer service. JD has a loyal customer base in China and its topline has grown consistently. But look at JD’s stock price (Blue: JD, Orange: BABA, Purple: PDD)

Just for comparison, Coupang trades at 1.3x sales, versus JD at 0.3x. My point here is that de-rating in e-commerce can be brutal. And things like “in-house logistics”, “delivery speed”, and “loyal customers” quickly goes out the window when the market starts to harbor serious concerns about competitive threats and long-term growth.

Here’s another issue with Coupang. Its shareholder base consists almost entirely of foreign investors. How many have used Coupang? Wait, let’s take a step back. How many have even been to Korea? How many can name another Korean city, besides Seoul?

The party will keep going as long as the narrative holds. However, at the first sign of trouble when narrative violation becomes a real possibility, you probably will not see many “diamond hands” among Coupang’s shareholder base.

The ironic thing is that, even if Coupang’s business remains fine (in spite of all the competitive and political risks that I’m about to get into), the stock might not.

Is Coupang actually special, or as Charlie Munger said, just another “god damn retailer”?

One can break down the e-commerce market into discovery and search-based e-commerce.

Discovery is when users are shown items based on recommendation features. It might be products that users don’t need right away, but end up purchasing anyways because the deal is too good to resist. Let’s say portable air humidifiers - users don’t mind waiting 7 days for delivery, if it means they can get it for $4 on Aliexpress versus $12 on Coupang. Low prices, algorithm, and gamification are key to winning in discovery-based e-commerce. This is what the Chinese players are good at.

Search-based e-commerce applies to products that users specifically search for and need right away. For example, baby diaper - there is a specific brand that people are used to buying, and they need fast delivery. Coupang dominates this space.

Coupang’s sales of diapers is going to be safe for quite some time. But there are only so many diapers customers can buy. If you think about Coupang’s ability to increase share of customer spend over time, it’s hard to imagine that the massive and growing volume of discovery-based commerce that is happening on Aliexpress/Temu won’t have an impact.

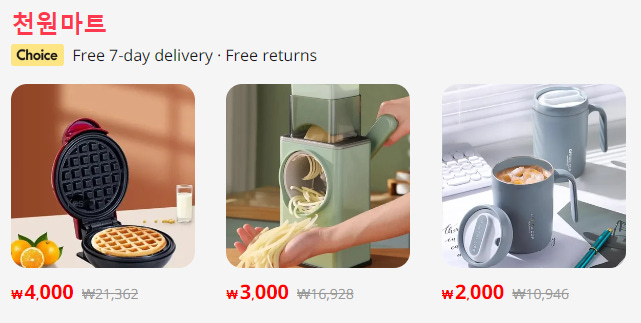

Here’s a flash sale at Aliexpress:

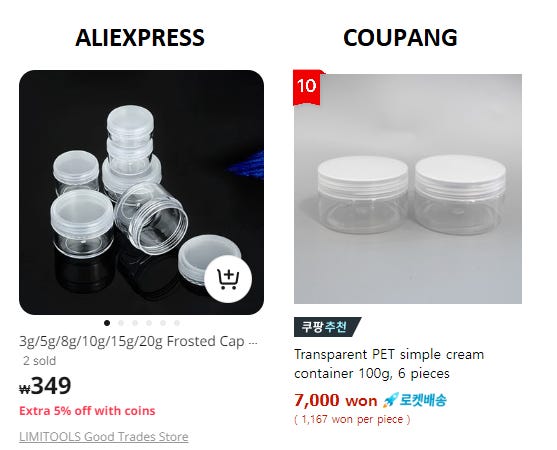

And some more examples of price comparison between the two platforms:

In case you think I’m just cherry picking examples from above: take note of the red numbered tags on top of the Coupang listings. It means they are best-sellers within the search term or categories. Which means they are some of the best that Coupang has to offer, value wise. So we are comparing average Aliexpress listed items with Coupang’s best sellers. This shows you what Coupang stands to lose.

Also, how do you think Coupang manages to achieve their “everyday low prices”?

You might then ask: how is all this stuff going on at the Chinese platforms sustainable? The answer is that it’s not. But there’s also something that’s being underestimated…

Aliexpress is in Korea for the long-term

I believe Aliexpress wants to be more than just a place where Korean users buy “cheap crap from China”. They are thinking more long-term and strategically about the Korean market than people realize. They want to become a true local player that can compete head to head with Coupang and Naver across all areas.

While Aliexpress may have entered the market with disruptive/predatory practices, if you look at their recent execution, it reveals extensive efforts to localize.

Partnering with major Korean brands

You can find an increasing selection of major Korean F&B and consumer brands on Aliexpress, including CJ, Lotte Chilsung Beverage, Dongwon, Ottogi, LG Household & Healthcare items. These are all major national brands in Korea.

CJ CheilJedang, which is the largest packaged food brand in Korea, partnered with Aliexpress after a dispute with Coupang on pricing. As a result, CJ’s food no longer qualifies for rapid delivery on Coupang (sales volume on Coupang will take a massive hit as it now takes 3 days to deliver compared to overnight).

Side note: CJ Logistics is Korea’s largest logistics company and delivers 80% of Aliexpress parcels. So CJ’s move here to get closer to Aliexpress isn’t that surprising.

But CJ is not really unique in the sense that pretty much all the consumer brands in Korea fear Coupang turning into a monopoly and gaining too much power. This is why brands were so quick to support Aliexpress.

By partnering with more Korean brands, Aliexpress also derives more legitimacy in the eyes of Korean consumers. It can shed its image of being a cheap Chinese platform.