Air Water (4088)

The last bargain industrial gas company?

Disclaimer: The information in this article reflects the personal views of the author and is provided for informational purposes only. It should not be construed as investment advice. The author holds a position in the security at the time of publication. Investment funds or other entities with which the author has consulting or advisory relationships may or may not hold a position in the security/securities discussed. The views expressed are solely those of the author and do not reflect those of any other parties. Readers should conduct their own research and consult a qualified financial advisor before making any investment decisions.

Introduction

Air Water is Japan’s #2 industrial gas company, with c. 30% share in air separation gases. The market leader, Nippon Sanso, holds closer to c. 40%.

Why should you pay attention? Because it’s an industrial gas company still flying under the radar of most global investors, and it might just be the last clear “bargain” still left in this amazing sector.

But of course, there are reasons for this: Air Water has long struggled with both a lack of focus and a lack of growth.

The lack of focus is almost legendary. Since 2000, Air Water has made 245 acquisitions, most of them unrelated to industrial gas. The company happens to be Japan’s largest producer of table salt (42% share) and also raw ham (30% share). Yes, you read that right. And the list goes on — the company is a bottler of canned and bottled juice beverages, producer of aerosol sprays, sells electricity from its own biomass power plants, processes vegetables, owns a supermarket chain, makes construction supplies…you get the point.

Even in its industrial gas business, the business returns in Japan have historically been unattractive. The market offered no growth and pricing has remained flat. This stands in contrast to most other developed markets, where industrial gas has been a standout business.

However, there are some signs of positive change:

Air Water’s industrial gas business is improving.

In Japan, margins are expanding thanks to pricing increases and contract rationalization. The growth of Japan’s semiconductor industry has also been a tailwind, as new fabs require steady supplies of nitrogen and specialty gases.

Air Water has been growing outside Japan; it became the #3 player in India after it bought the Indian assets of Praxair and Linde in 2019, and the company also has operations in the US.

There is a governance improvement story here, although I’d characterize it as still in the very early stages. The new mid-term plan announced in June marks a shift in focus from topline growth to profitability, with plans for business exits and divestments, as well as a 1 trillion yen market cap target.

The chart below compares the 10 year performance of Air Water and Nippon Sanso, its main Japanese rival. The performance gap between the two should continue to attract investor attention and add pressure to Air Water’s management. Will it finally be Air Water’s turn to re-rate?

There hasn’t been any activist involvement yet in the name, and I see this as a good set-up. Air Water has no controlling shareholder, trades below book, owns many noncore assets that can be divested, and importantly, industrial gas is a high-quality, globally proven business model with the potential to command a significantly higher multiple.

For global investors, this is a chance to buy a longstanding industrial gas company at a valuation that could, in hindsight, look absurdly cheap.

Industrial gas

(If you are already familiar with the industrial gas business model, feel free to skip this section)

I recently heard Linde’s CFO describe the industrial gas business as an “unregulated utility”.

It’s like water and electricity in your home — one of the most important things in your life that you rely on everyday, but pay very little for compared to your other life expenses.

Similarly, industrial gas is essential to countless businesses. For them, the cost of gas is relatively small, but it’s mission critical. They cannot run their operations without it.

For customers, reliability comes first when choosing suppliers, before cost. They have a preference for established players and are unlikely to switch suppliers unless something goes very wrong. This results in an industry dynamic that highly favors the incumbents.

Going deeper, the three main supply models are:

On-Site/Pipeline: The industry gas company builds ASU (air separation unit) at or near the site of a large industrial customer (typically steel, petrochemicals, or semiconductors). It owns and operates the facility, and sells gas to the customer under a long-term supply agreement (10-20 years), typically with minimum purchase commitment and inflation-protected pricing.

Bulk/Merchant: Gas is produced at a central ASU, liquefied, and transported to customers using specialized trucks. At the customer site, it is stored in on-site cryogenic tanks, then vaporized and used as needed. The gas company typically owns both the trucks and the on-site storage tanks, providing a turnkey solution. Customers usually sign supply contracts, although the contracts are much shorter (5 years or less) than the onsite contracts.

Cylinder/Packaged: Gases are compressed into cylinders at filling plants and distributed to smaller end-users through a network of third-party regional gas distributors. This model serves smaller users that don’t require continuous gas supply.

The three supply models are often interconnected. A large ASU might primarily serve an on-site customer under a long-term contract, but also produce excess gas that can serve nearby customers under the bulk and packaged models. This allows the gas company to better manage the ASU utilization and bring down the per-unit cost. Think of it this way: onsite is the foundation while the bulk and packaged models help to further drive the return on capital.

This is also the reason why industrial gas companies can run the ASU better than a customer can do it by themselves if they were to own and operate in-house.

The key moats in this business are:

Switching cost: most evident in the on-site model, where customers are locked into long-term contracts. Even in the bulk and packaged models, gas is mission-critical and customers are naturally reluctant to switch suppliers.

Low-cost: Having multiple customers around a single ASU and building dense delivery routes results in lower cost to serve each customer (through better utilization of ASU and more efficient delivery).

Distribution: Reaching small, fragmented users requires strong local networks, often built through partnerships with regional distributors.

Lastly, domain-specific expertise and product offerings matter a lot in certain sectors.

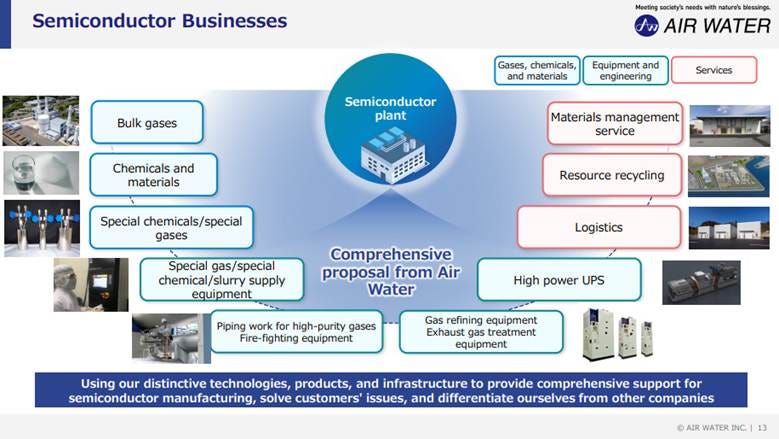

In semiconductors, fabs require more than 100 types of special gases for various production processes, along with specialty chemicals and non-gas services like logistics and materials recycling. Industrial gas majors can provide all of these.

In healthcare, gas companies don’t just supply medical oxygen; they also build medical gas piping systems and supply hospital with both goods (e.g. medical supplies) and services (e.g. supply chain management, logistics).

In these areas, winning often requires a full value chain approach rather than being able to sell just the gas.

Business drivers: Japan and India

Japan

In Japan, Air Water has recently begun to exercise its pricing power. The company raised prices in April 2024 and again in January 2025—by over 10% for air separation gases and 20–30% or more for specialty gases. Beyond pricing, there is also significant room to rationalize and improve contractual terms, which in many cases lag behind global standards. Both of these should serve as margin drivers going forward.

The semiconductor industry is emerging as a key growth driver.

A major industry trend is that fabs are increasingly looking for partners capable of providing total facilities management. Air Water is well-positioned to meet this demand, offering a comprehensive suite of gases, chemicals and materials, as well as on-site services.

Air Water supplies Japan’s two main memory makers, Kioxia (formerly Toshiba) and Micron (formerly Elpida Memory which got acquired by Micron), in addition to other key discrete, power, and analog players in the country.

Air Water is investing in a large on-site gas facility for Kioxia’s new plant (phase 2 of Kitakami, Iwate), which will produce the 8th generation NAND chips for AI applications starting in September 2025. Micron’s Hiroshima fab, also supplied by Air Water, is expected to undergo capacity expansion for advanced DRAM manufacturing by 2027.

While the memory market deteriorated in 2H 2024, Kioxia management expects inventories to normalize by mid-2025, followed by demand recovery in 2H 2025 (Kioxia’s recent share price momentum seems to support this). Another catalyst is the end of Windows 10 support in October 2025, which could lead to further PC demand.

An underpenetrated area for Air Water is cutting-edge logic, but breaking into this isn’t easy.

So far Air Water has lost out to Nippon Sanso for the gas supply contract to Rapidus in Hokkaido. In Kyushu, Air Liquide is supplying TSMC’s fab #1.

It seems like Nippon Sanso and Air Water are now competing for Fab #2 which is under construction and set to commence operations in 2027.

Air Water has build a “multipurpose facility” near TSMC, so it looks like it has won some kind of contract here (probably logistics or materials procurement).

The key question is whether TSMC will be looking to diversify from Air Liquide in Japan. This may be a challenge as Air Liquide has already invested a significant amount of money in Kyushu.

Of course, any supply wins with Rapidus or TSMC would be huge news, although at this point I think the probability is low.

If you’re interested in Japan’s semiconductor industry, also check out Japan Materials (6055), which I think is the closest peer to Air Water’s semiconductor business. It’s a niche company that provides services to fabs, including procurement, engineering, and maintenance. Kioxia is also the main client (Yokkaichi fab), resembling Air Water. Note that Japan Material’s revenue is roughly half the size of Air Water’s “Electronics” segment (for semiconductor industry) and it trades at a market cap of JPY 150 bn which is one third of Air Water’s total market cap.

India

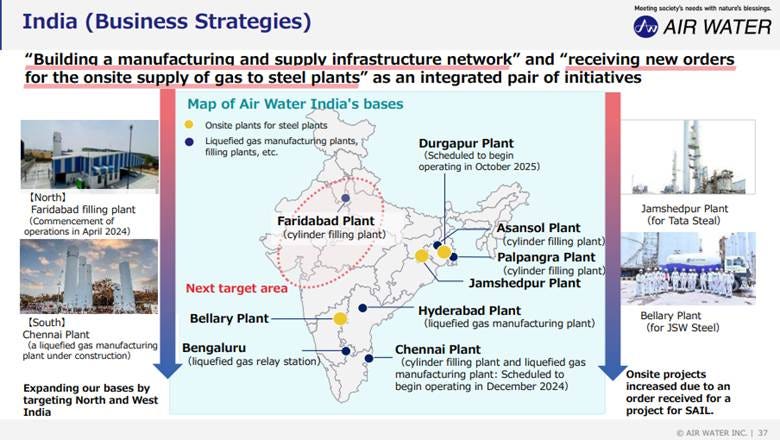

Air Water entered India by acquiring Linde and Praxair’s assets divested as part of the regulatory requirements needed for their 2018 merger.

These are profitable on-site businesses supplying India’s largest steelmakers (Tata Steel and JSW). The prices paid appear reasonable — 2.7x sales for Praxair’s business (which includes on-site supply to Tata Steel’s Jamshedpur plant) and 3.5x for Linde’s business (includes on-site supply to JSW’s Bellary plant). The Japanese company didn’t overpay this time! The deal also included regional gas filling stations giving Air Water a foothold in the regional markets to serve smaller-scale users.

According to Frost & Sullivan, India’s industrial gas market was valued at USD 1.2 bn in 2023. The market is projected to grow at 4.3% CAGR by volume and 7.5% CAGR by value from 2024 to 2028.

Air Water India has #3 market share, behind #1 Linde India and #2 INOX Air Products (JV between INOX and Air Products & Chemicals).

The risk here is that Air Water India has very high exposure to India’s steel industry. It’s a growing industry — India’s crude steel output is expected to reach 210 MT by 2030, up from 125 MT in 2023 and on a per capita basis India remains well below global averages (India 88kg/person vs. China 700kg, Japan 696kg, and US 270kg). But we also know this industry is highly cyclical.

In September 2023, Air Water won a major on-site contract for state-owned SAIL’s Durgapur Plant, with operations set to begin in October 2025. This adds roughly 28% to Air Water India’s currently installed capacity. With this, Air Water now does business with three of the top four Indian steelmakers. It’s impressive that the SAIL win was organic, although one has to wonder what kind of terms were necessary in order to secure a deal with a client like SAIL…

According to Air Water’s management, they are “receiving multiple inquiries from blast furnace makers”. So the business sounds solid, as long as India’s steel industry can keep pace.

Management also commented it’s interested in doing an onsite business in Western India. This might possibly be in connection with Tata’s planned semiconductor fab in Western India, which Air Water is reportedly competing for. This would be a big win.

Note that the only listed industrial gas pureplay in India at the moment, Linde India, trades at a market cap of RS 595bn (EV/sales: 22x). Applying this to Air Water India’s sales of JPY 20.1 bn would imply a valuation of JPY 442 bn, which is close to 100% of Air Water’s market cap.

Of course, this comparison is premature as Air Water has not disclosed any plans to list its Indian business (and based on my conversation with IR, it does not appear to be under active consideration at the moment).

That said, I believe there’s a business case for listing in India. Doing so would allow Air Water to tap into the high valuations of the Indian market and raise capital to capture new customer segments, supporting its diversification away from its current heavy exposure to the steel sector. It’s also worth noting that a local Indian industrial gas player, Ellenbarrie, is set to go public soon (Fun fact: Air Water held a 51% stake in Ellenbarrie until 2021).

Management

A brief history: There were three key figures in Air Water’s history: Hiroshi Aoki (born 1928), Masahiro Toyoda (born 1932), and Kikuo Toyoda (born 1948). The two Toyodas are believed to be brothers, separated by 16 years. Kikuo Toyoda is the current Chairman and CEO.

Aoki was the long-time executive at Daido, the predecessor company of Air Water. He ran the company from the time of merger with Hokusan (1993) until 2015, and is the key architect behind Air Water’s historical M&A strategy (i.e. the empire builder). His protégé, Masahiro Toyoda, succeeded Aoki from 2015 to 2019 (Aoki passed away in 2018). In 2019, Toyoda passed on the torch to his younger brother Kikuo (Masahiro, 93 years old, still sits on the board but has no formal title/functions).

I’m not sure what the relationship is between Aoki and the Toyoda brothers — my guess is they are either extended family or the Toyoda brothers were part of the founding family at Daido or some other company that got absorbed into the group. In any case, Air Water should be considered a “family company” since Kikuo Toyoda likely sees himself as a family member rather than a hired CEO.

The key question is whether Kikuo Toyoda is better than his predecessors.

Is he a hardline reformer or a staunch governance advocate? No.

But is he the exact same as his predecessors? No.

My view is that he sits somewhere in the middle. I’ll lay out the facts here and let you decide.

Under Kikuo Toyoda, the most notable shift has been a renewed focus on the industrial gas business, with overseas growth being made into a key priority. FY2021 marked a turning point. Before this, investments were scattered across a range of non-core businesses, but since then, it has become apparent that industrial gas has become the focus for investments.

HR decisions aligned with the above:

The most significant was promoting Ryosuke Matsubayashi to President and COO in March 2023. Matsubayashi is a gas engineer by background who previously led R&D and served as CEO of Air Water America before taking charge of global operations in India and the U.S. He seems highly motivated to make the company more global - e.g. he introduced a policy requiring all new graduate hires in Japan to complete a three-month overseas training program in either India or the U.S.

Newly appointing Rochelle Kopp, a non-Japanese, as independent director. Kopp is a cross-cultural communications expert and also sits on the board of MS&AD Insurance, Japan’s second-largest non-life insurer. This seems like a step in the right direction.

New mid-term plan (“terrAWell30 2025-2027”) - link here

Sell-side analysts seem very positive about the new midterm plan. SMBC Nikko called it a “major reform,” while Bank of America described it as a “major shift.”

The mid-term plan touches on a range of topics, but in my view, the most important for investors to assess is the company’s stance on its business portfolio. Specifically, its willingness to divest non-core businesses.

During the Q&A session of the mid-term plan, Chairman Toyoda described the company as follows:

冷蔵庫の中にはたくさんものが入っていて、何が入って いるかは忘れているものもあるし、隠れているものもある。その状態が今のエア・ウォーターグループです。 未知のものがたくさんある一方で、中には捨てるものもあります。

Translation: “There are a lot of things in the refrigerator, some of which we forget what is in there, and some of which are hidden. That’s the current state of the Air Water Group. While there are many with potential or hidden value, there are also things that need to be thrown out.”

In line with this, Air Water will conduct a “comprehensive review” of the business portfolio.

Detailed disclosures were limited, but the company did provide one clear quantitative benchmark: businesses with operating margins below 5% will be classified as “low-profitability” and subject to strategic review.

In total, the businesses under review will be roughly 50 bn yen in revenue, or about 5% of the company’s total.

FY2025 has been designated as a review period, although based on my conversation with IR, it sounds like the first actual business divestment is more likely to take place in 2–3 years, toward the end of the mid-term plan.

The plan also includes capital market goals, including market cap of 1 trillion yen by 2030 and a stated aim to “continuously improve P/B ratio through earning a return on capital in excess of cost of capital” (however, worth noting that these goals are not currently tied to executive compensation).

Profitability continues to be the focus: “Comprehensive reassessment of low-margin dealings by product and customer” and “Thorough price management to secure the resources necessary for business continuity.”

IR mentioned that both Chairman Toyoda and President Matsubayashi have begun meeting with investors for the first time — a small but encouraging sign of improved engagement with investors.

My initial reaction was one of slight disappointment. While the overall direction looks positive, the company is still in the very early stages of transformation, and there’s clearly a lot left to do. The pace doesn’t feel fast enough and there doesn’t seem to be much urgency behind it.

That said, I do think there is a kind of a governance “put” here: If the business does well, then great. If it doesn’t, underperformance could prompt accelerated reform, as we’ve seen with other Japanese companies.

Another potential catalyst is the future involvement of activist investors.

Valuation and return profile

Based on my sum-of-the-parts (SOTP) analysis, I believe the stock is trading roughly 40% below fair value. This is a conservative estimate — for example, I applied a 30% discount to peer multiples when valuing the industrial gas segment.

Management is guiding for a 10% profit growth p.a., plus a 3.5% dividend yield, with additional upside from multiple expansion driven by governance improvements. At 9x forward P/E, the valuation looks undemanding. Altogether I think it’s reasonable to underwrite a 15–20% annual return from current levels.

For context, Nippon Sanso trades at 23x P/E, which suggests that multiple expansion is the single largest source of upside potential if Air Water can close even part of that gap.

In a downside case where profit growth remains sluggish (say 5% annually, in line with the past three years) and governance reforms fail to gain traction, investors could still see a return of 8% (5% growth + 3.5% dividend). While that won’t be exciting, it’s a pretty reasonable floor in my view.

Disclosure: The author holds shares of Air Water at the time of publication and may choose to sell these shares at any time without notice. This article does not constitute investment advice. Please refer to the disclaimer at the beginning of this article, and always conduct your own due diligence before making any investment decisions.